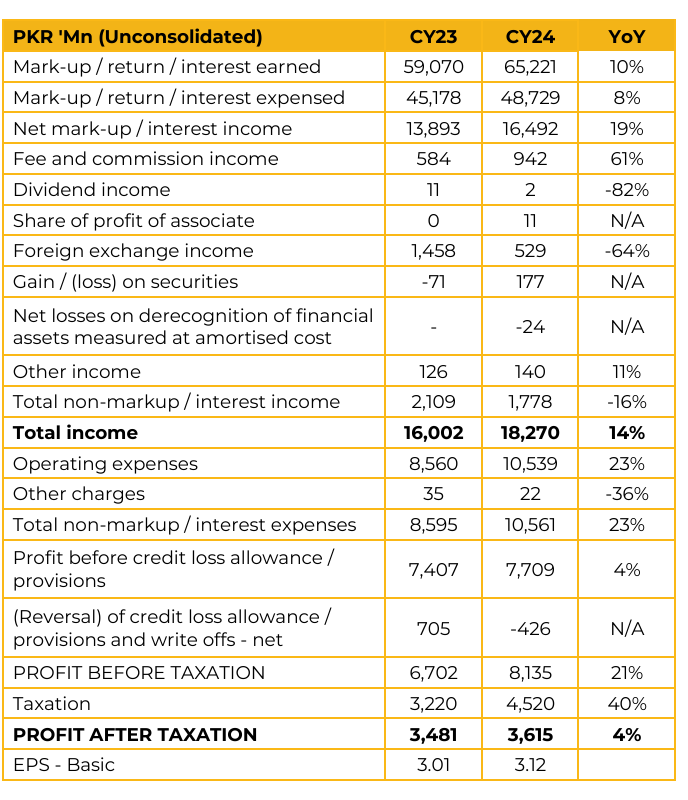

Bank of Khyber (BOK) reported earnings per share of PKR 3.12 for CY24, compared to PKR 3.01 in CY23. The Board remains committed to full conversion into an Islamic bank by Dec-2026. To date, 59 conventional branches have transitioned. The deposit base is also shifting, with Islamic deposits rising to 48% of total (32% a year ago), while conventional deposits have reduced to 52% (68% earlier).

Investments grew by PKR 68.9bn during the half year, while deposits surged 38%. Conversely, advances contracted 21%. Asset quality continues to improve — net NPLs to net assets declined to 1.49% (vs. 2.55% in Dec-2024). The bank maintains a strong CAR of 21.2%. Notably, BOK’s credit rating has been upgraded twice in the past five years to AA-, underlining balance sheet resilience.

Management is prioritizing cheaper funding. Private-sector deposits climbed 32% to PKR 170bn, with current accounts rising 25% to PKR 89.8bn (23.5% of total). The bank is intentionally shedding high-cost deposits, aiming to raise current accounts to 35–40% of the deposit mix over the next three years. BOK sees significant opportunity in SMEs and is expanding its team to penetrate underserved markets.

Consumer lending, currently negligible will be developed under a full strategy (auto, housing, personal loans, salary advances), adding scale and sticky yields over time. Average yields during 1H25 stood at 12.8% on investments and 13.2% on advances. In line with its transition plan, BOK is avoiding long-tenor fixed instruments, with fixed holdings expected to become negligible by Jan-2026.

The bank declared its first-ever interim dividend of PKR 1.5/share. Management targets a 50–60% payout ratio, supported by strong CAR and liquidity. Future interim frequency (quarterly or otherwise) remains at the Board’s discretion. Management anticipates monetary easing from Jan-2026, as food inflation linked to floods normalizes, creating a potentially supportive rate environment.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.