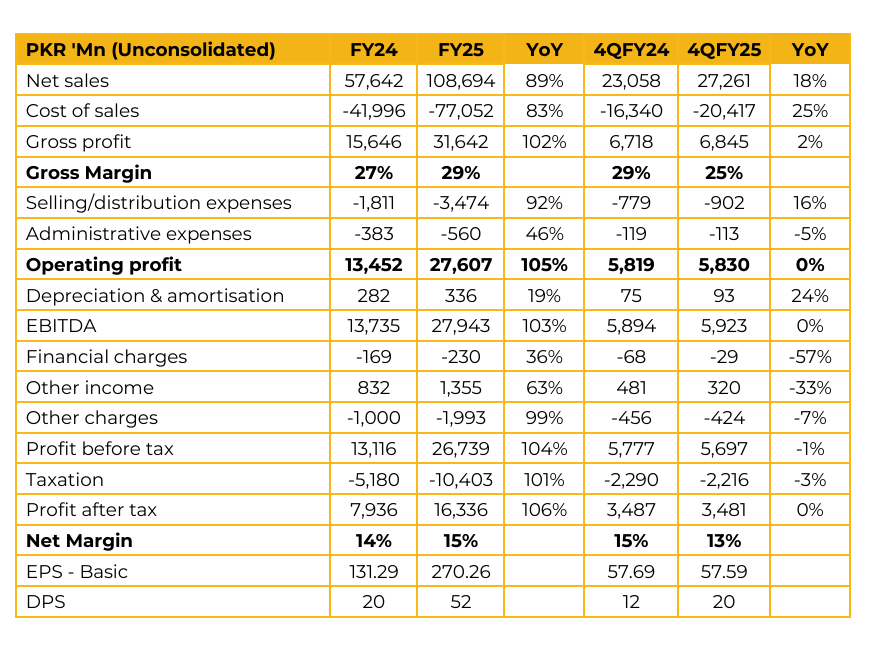

Sazgar Engineering Works Limited (SAZEW) reported earnings per share of PKR 270.26 for FY25, compared to earnings per share of PKR 131.29 in FY24. Furthermore, in 4QFY25, the company reported earnings per share of PKR 57.59, compared to earnings per share of PKR 57.69 in the same period last year (SPLY). The company’s actual output is running closer to 60 vehicles per day, compared to its installed capacity of 40. Following the planned expansion, management expects single-shift capacity to rise to 100–120 vehicles per day, with the enhanced facility designed to assemble the complete model range, including NEVs, hybrids, EVs, and petrol variants.

The PHEV variant received a strong initial response, pushing delivery timelines from 2–3 months to 3–4 months due to an unprecedented surge in bookings. At the same time, management highlighted that petrol H6 volumes have skyrocketed, leaving the current sales mix more petrol heavy despite continued growth in hybrids. In 4QFY25, the reported gross profit margin eased to 25.1%, down from 32.6% in the March quarter, which the company attributed to a higher share of lower margin variants. Looking ahead, management guided that, post-expansion, the company aims to broaden its portfolio and compete more aggressively in mainstream SUV price bands. Once the plant ramps up after March 2026, SAZEW plans to introduce the Tank PHEV and Canon PHEVs.

Management also highlighted that the overall light-vehicle market has grown to 120–130k units annually and continues to expand, and the company intends to grow in line with industry trends. On the export front, SAZEW is evaluating additional routes and aims to expand three-wheeler placements in Afghanistan, Mexico, and the Philippines.

The three-wheeler segment is now localized up to 80%, which strengthens competitiveness. By contrast, four wheeler exports remain uneconomical at this stage. The current auto policy, which underpins SAZEW’s concessional duty structure, will expire in 2026, after which duties will revert to normal unless renewed. Management’s mitigation strategy is to leverage the expanded capacity coming online by then, driving higher volumes to dilute unit costs and resetting prices where required.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.