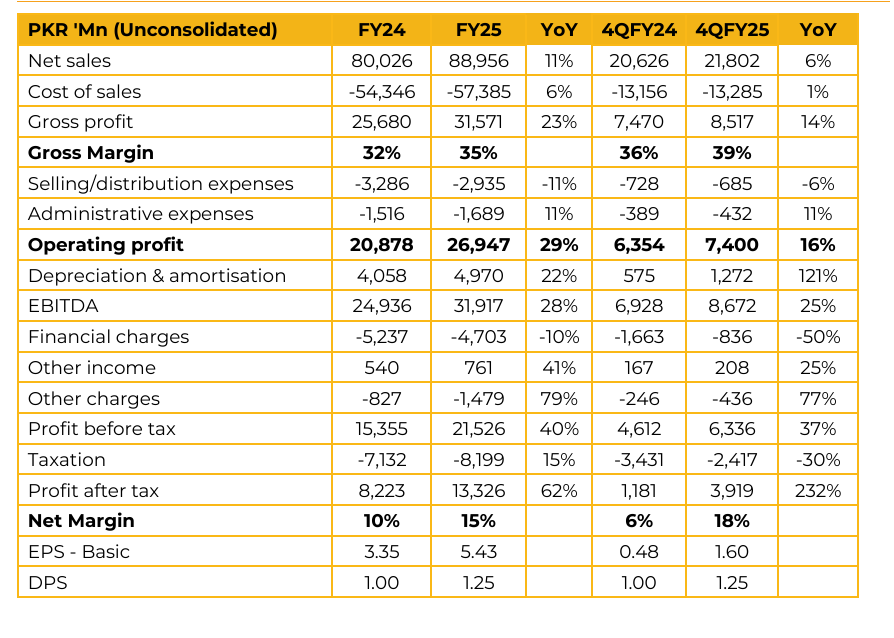

Fauji Cement Company Limited (FCCL) reported earnings per share of PKR 5.43 for FY25, compared to earnings per share of PKR 3.35 in FY24. Furthermore, in 4QFY25, the company reported earnings per share of PKR 1.60, compared to earnings per share of PKR 0.48 in the same period last year (SPLY).

Management highlighted that capacity utilization, which stood at 51% post-expansion, is expected to improve to 55–65% over the next two to three years as demand strengthens. According to management, grid power tariffs have eased to ~PKR 31/unit from ~PKR 33, providing cost relief. Local coal currently represents ~75% of the fuel mix, with a utilization target of 80–85% as supply chains normalize.

At present, alternate fuels contribute ~5–7% of the mix, while indicative fuel prices are PKR 36–37k/ton for local coal and PKR 38 39k/ton for Afghan coal. On the packaging side, vertical integration is yielding benefits, with polypropylene bags now largely produced in-house, generating savings of ~PKR 4 per bag compared to market procurement. On the pricing and market front, local net retention stands at PKR 15–16k/ton, whereas export retention is at PKR 10.5k/ton.

Afghan exports remain firm, and management is actively seeking to establish a sea-export channel from the DG Khan plant, though competition from southern players remains a challenge. In the near term, export opportunities could include clinker shipments to Sri Lanka and Bangladesh.

On the regulatory side, the increase in royalty from PKR 250/ton to PKR 1,200/ton remains under litigation. FCCL has secured a Supreme Court stay order on the matter and is confident of a favorable resolution. Looking ahead to FY26, management anticipates domestic cement demand growth of 4–5%. Together with Afghan exports, FCCL targets an 8–9% YoY increase in overall volumes, and expects to outperform industry growth by 1–2%. The September floods led to a temporary slowdown in Punjab during the first half of the month, but as water levels recede, management expects any weakness in the first quarter to be compensated by a recovery in demand during the second quarter.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.