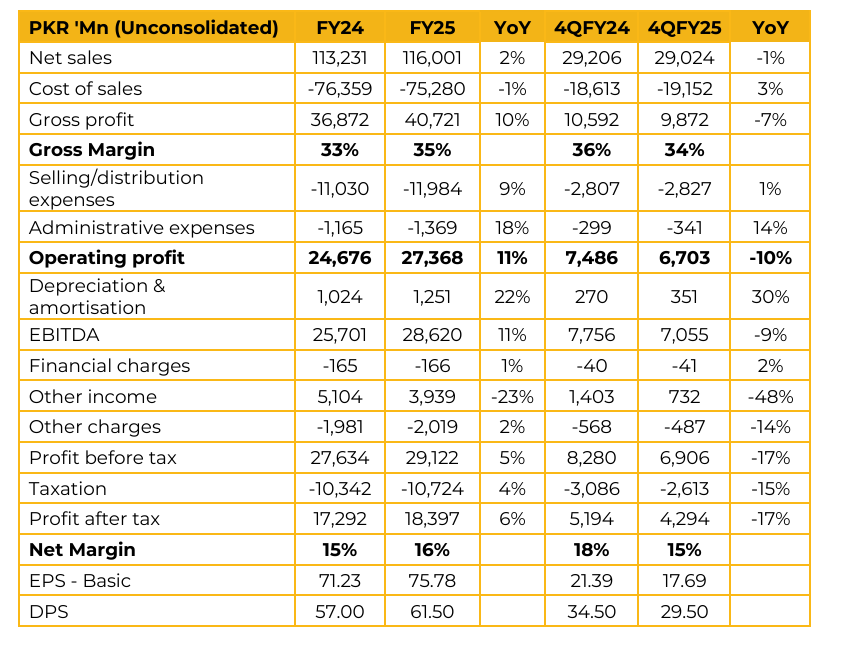

Colgate Palmolive (Pakistan) Limited (COLG) reported earnings per share of PKR 75.78 for FY25, compared to earnings per share of PKR 71.23 in FY24.

Furthermore, in 4QFY25, the company reported earnings per share of PKR 17.69, compared to earnings per share of PKR 21.39 in the same period last year (SPLY).

The company has recently diversified into the cleaning supplies category and test-marketed a new detergent under the brand name Toofan. In addition, it has installed in-house solar capacity at Sundar plant capable of generating 367 MWh of energy annually.

Management highlighted that per capita annual toothpaste consumption in Pakistan stands at 85 grams, and the company is running awareness campaigns to encourage higher usage. This year proved particularly challenging for the detergent segment, as the growing presence of unregistered retailers disrupted the market. Many local players operating in the non compliant segment benefited from a lower cost of doing business, which in turn exerted downward pressure on compliant players and distorted overall market dynamics.

The company remains highly dependent on imported raw materials, with 75% sourced externally. A relatively stable exchange rate has supported gross margins. Within its portfolio, oral care continues to deliver the highest margins, while detergents generate the lowest. Management estimates a market share of 30–38% in detergents and 50–60% in dishwashing products. For FY26, management expects revenue growth expected to be in line with inflation.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.