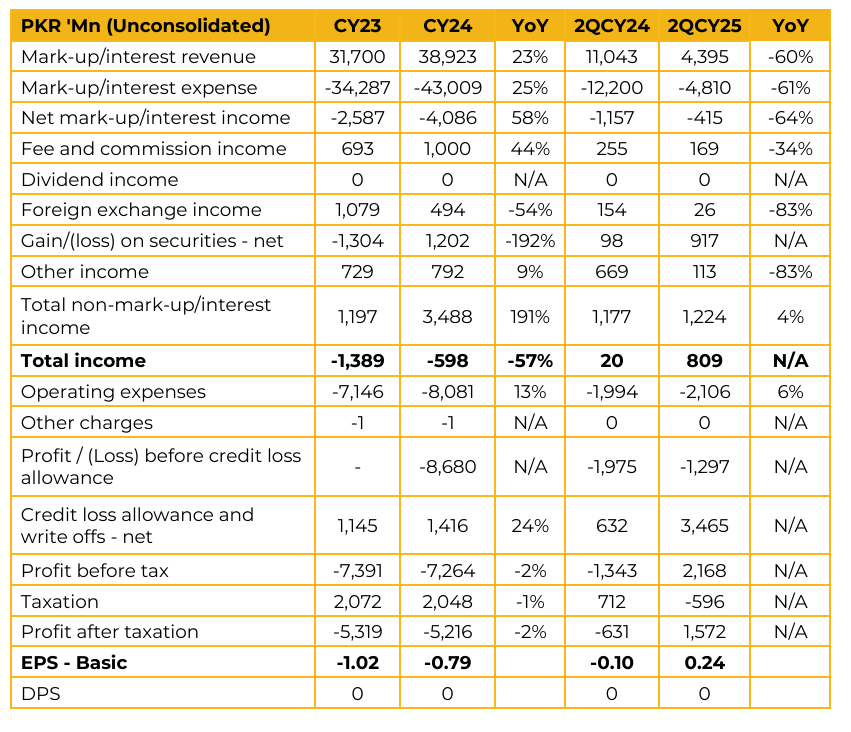

Bank Makramah Limited (BML) reported loss per share of PKR 0.79 for CY24, compared to PKR 1.02 in CY23. Furthermore, in 2QCY25, the company reported earnings per share of PKR 0.24, compared to loss per share of PKR 0.10 in the same period last year (SPLY).

Deposits increased from PKR 157bn to PKR 186bn in CY24 despite the absence of a formal credit rating. This growth was supported by a PKR 10bn equity injection from the sponsors, which provided the capital backbone for stabilization. The Bank’s CASA ratio has strengthened to almost 95% (up from 90%). Additionally, it ranks among the lowest cost-of-funds profiles in the industry.

Notably, this was achieved with a footprint of just 160 branches. Management views this as a replicable competency and sees potential to double the deposit base once capital and ratings normalize. At that stage, the Bank plans a calibrated re entry into short-tenor, trade-linked funded exposures and a secured consumer portfolio. The Bank is also in the process of transitioning to a full-fledged Islamic institution. Currently, 94 branches have been converted to Islamic operations, with full conversion still underway.

On the asset side, management highlighted progress on the sale of Cullinan Tower. A signed sale agreement valuing the building at PKR 12bn has been executed, with PKR 1bn already received as a non-returnable advance. The Bank expects to close the transfer well ahead of the one-year contractual deadline. On the regulatory front, management expressed confidence that the Bank will become compliant with both MCR and CAR requirements during the current quarter. Additionally, the amalgamation of the Haly Group is expected to be completed within the next 1.5 months. Following this merger, along with an additional PKR 5bn equity injection from the sponsors, the capital position will be further reinforced. Regarding non-performing loans, management added that the PKR 10bn court settlement has reached the execution stage. Cash realization from this recovery is expected within the next quarter.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.