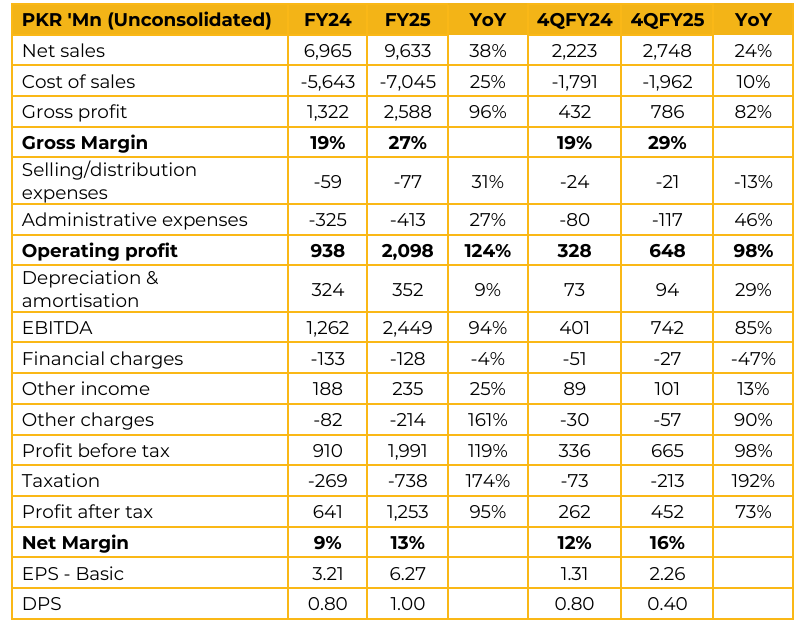

SPEL Limited (SPEL) reported earnings per share of PKR 6.27 for FY25, compared to PKR 3.21 in FY24. Furthermore, in 4QFY25, the company reported earnings per share of PKR 2.26, compared to earnings per share of PKR 1.31 in the same period last year (SPLY).

The company’s revenue mix comprises approximately 20% from the auto sector and 80% from the FMCG and food packaging industries. Around 25% of its energy requirements are met through solar power. A 3MW solar plant is already operational, with an additional 600kW expected to come online in the coming months. Approximately 95% of the company’s raw materials are imported.

Management is engaging with several auto companies for parts manufacturing opportunities, aiming to capitalize on potential demand as current auto policy incentives expire in 2026. SPEL is the largest private sector mold maker in Pakistan.

Its key FMCG and food packaging clients include Unilever, Pakistan Tobacco, and Colgate, while key auto clients include Suzuki, Toyota, and Honda.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.