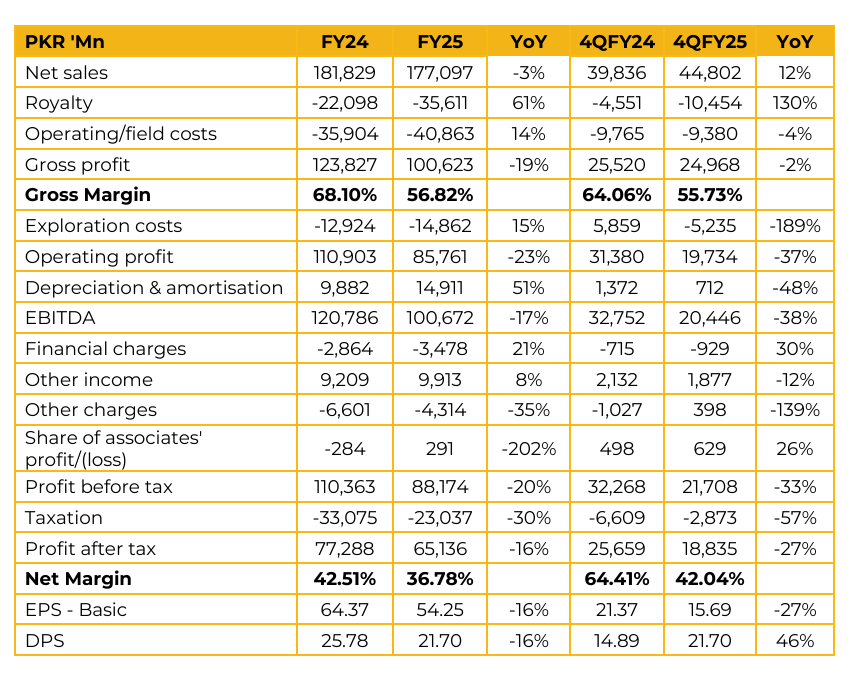

Mari Energies Limited (MARI) reported earnings per share of PKR 54.25 for FY25, compared to PKR 64.37 in FY24. Furthermore, in 4QFY25, the company reported earnings per share of PKR 15.69, compared to earnings per share of PKR 21.37 in the same period last year (SPLY). The company is working on Block 5 in partnership with ADNOC, where three discoveries are currently under development.

The development plan has been approved by ADNOC, and production is targeted at approximately 25,000 barrels per day. Looking ahead, and in line with IMF restrictions, management is keen to ensure that future circular debt does not build up. To address potential gas curtailment, the company is coordinating closely with the government. An annual delivery plan has been submitted to Qatar, factoring in the deferral of certain cargoes.

The company aims to complete its first data center by the end of this year. The Karachi data center is progressing steadily, while the second data center is expected to be completed sometime next year. The Sadiq project remains on track and is expected to achieve first production by 2028. For the Shiva field, the production target was 70 MMCFD, and current output stands around 55–60 MMCFD, varying with daily demand from SNGPL. Management expects to cater to higher winter demand. A pipeline from Spinwam to Shiva is being laid, which will expand capacity to 100 MMCFD, enabling the company to maximize production whenever demand allows.

Regarding Spinwan flows, management commented that an additional 200 MMCFD of capacity will be added as part of the full field development plan, which is currently being finalized. SNGPL is simultaneously laying a new 18-inch pipeline, expected to take 2–3 years to bring the fields to full potential. Not all four discoveries will be brought onstream simultaneously; the development will be staggered in phases. The company plans to drill an average of 20 wells per year over the next five years.

A combined production target of 300 MMCFD is set for Shiva and Spinwam. Achieving this would require an incremental USD 400–500 million in capex if new processing capacity is imported, though costs could be significantly reduced if existing domestic capacity is utilized. Production from the Ghazij and Shawal fields can be increased to 220 MMCFD, depending on the allocation timeline, which will typically take 18–24 months after allocation.

The current processing capacity of HRL stands around 595–600mn MMCFD. With the ongoing pressure enhancement project, management aims to sustain current production levels to meet the fertilizer industry’s gas demand. Considering the ongoing negotiations between the Government of Pakistan and Qatar Gas, management believes that if the number of deferred cargoes can be reduced. The company continues to work closely with the government to minimize curtailment risk and ensure stable supply.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.