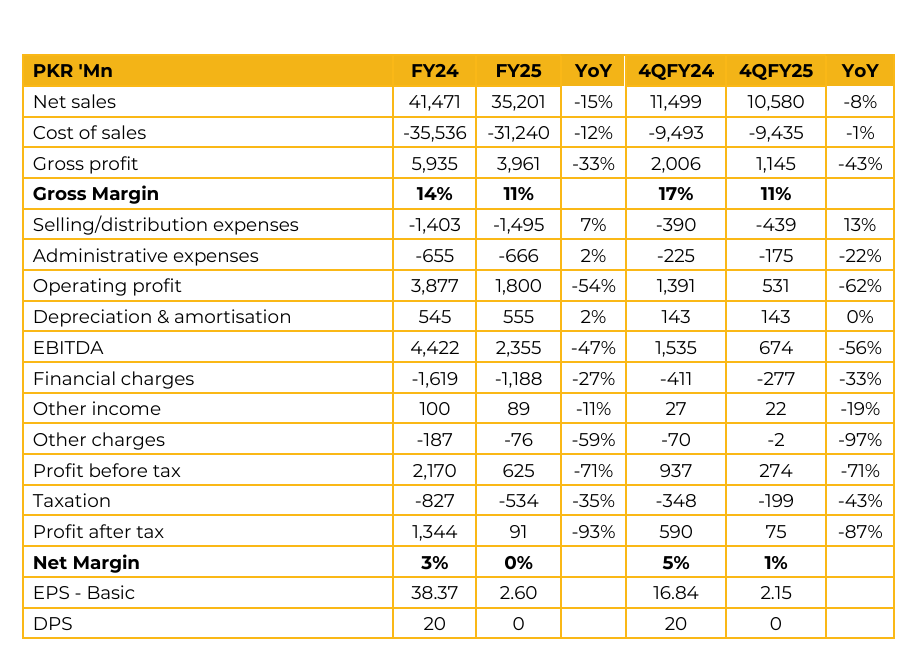

Atlas Battery Limited (ATBA) reported earnings per share of PKR 2.60 for FY25, compared to PKR 38.37 in FY24. Furthermore, in 4QFY25, the company reported earnings per share of PKR 2.15, compared to earnings per share of PKR 16.84 in the same period last year (SPLY).

Management reported a 10% decline in AMB sales within the replacement market, while MCB volumes rose by 22%. A visible shift in consumer demand from heavy to medium sized batteries has been observed, leading to lower average realizations. In the lead acid battery segment, the company does not foresee any major threat from imports.

However, management expressed concerns about the rising influx of lithium iron batteries, where premium coated imported variants could pressure local manufacturers. Management does not expect margins to improve over the next two years, citing the demand shift from heavy to medium vehicles the heavy segment previously contributed a higher share to profitability. Approximately 82% of total sales originate from the replacement market, primarily within the automotive segment.

According to management, Pakistan’s total battery demand stands near 10 million units annually, with Atlas Battery’s market share at around 20%. Despite broader macroeconomic headwinds, the impact has not yet fully reflected in sales volumes, though the company recorded a 6–7% YoY decline in unit sales.

Management continues to focus on operational efficiencies and will successfully pass through around 80–90% of cost benefit to customers. In the lithium-iron battery market, management noted that traders benefit more than manufacturers, as over 20 importers are sourcing surplus stock from China, and dumping where there is demand in the market. Medium-sized batteries, used both in vehicles and energy storage.

The transition from heavy to medium batteries is being driven by energy efficient electrical appliances and growing adoption of lithium technology, which together are reshaping consumer demand patterns. Lithium iron battery manufacturing in Pakistan remains unviable due to high Capex requirements, though partial or full-scale assembly is feasible locally.

Management plans to enter the lithium-iron space by next year, this would be a low Capex project, which may intensify market competition.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.