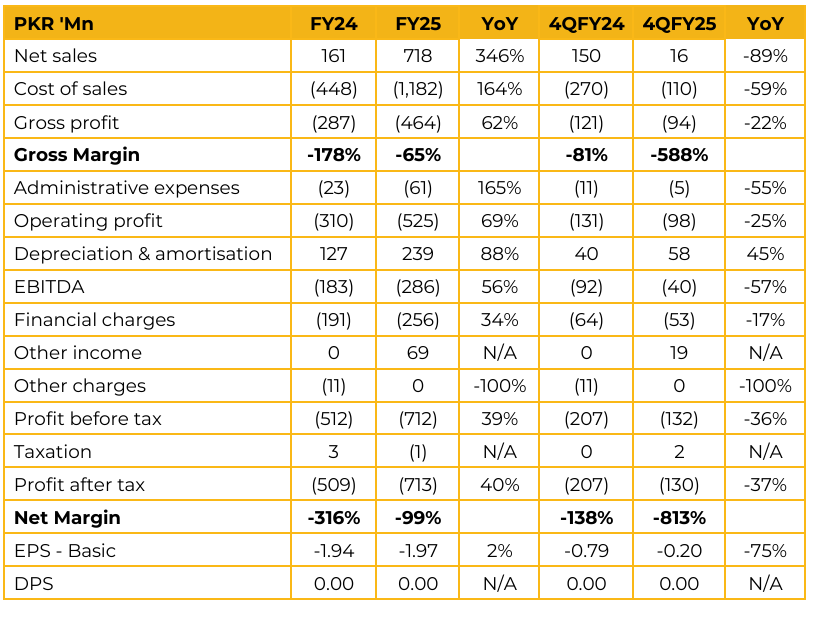

Baluchistan Glass Limited (BGL) reported loss per share of PKR 1.97 for FY25, compared to the loss of PKR 1.94 in FY24. Furthermore, in 4QFY25, the company reported loss per share of PKR 0.20, compared to loss per share of PKR 0.79 in the same period last year (SPLY). BGL has three plants namely Unit 1, 2 & 3. All three of them are currently shutdown reportedly for BMR purpose.

The company initiated rehabilitation with Unit 1. When previously operational, it achieved approximately 85% utilization (around 80-85 tons) of its 110-ton capacity. The primary cause of the plant shutdown was the lack of sufficient gas pressure and disruptions in supply, forcing Unit 1 to sometimes rely on expensive substitutes like HFO and LPG. BGL has constructed an independent gas pipeline (90% completed) to mitigate pressure issues that arose from the previous shared pipeline. Unit 1 is expected to become operational in FY 2026, Third Quarter (around March to June 2026), subject to securing adequate gas pressure and government approvals for gas supply. Unit 2 & 3 renovation and potential re-design/rebuilding of the furnaces will commence after Unit 1 is revived.

The company is continuously monitoring and updating molds, machinery, motors, and hydraulic components to ensure energy efficiency. The quantum and design of future capex for Unit 2 and 3 renovations are still in the early planning stages. BGL faces distinct gas pricing structures based on location and supplier: Units 2 and 3, situated in Lahore and Kot Abdul Malik, are attached to SNGPL and utilize RLNG rates, which are approximately PKR 3,000 per MMBTU, noting that this rate varies monthly. In contrast, Unit 1, located in Hub, is attached to SSGCL, where the effective rate is a mix of 90% Sui Gas price and 10% RLNG price, resulting in a cheaper rough rate of approximately PKR 2,300 to PKR 2,350 per MMBTU.

Going forward, company’s first priority is to bring BGL to its full potential and establish it on its own strength, which is expected to create a “healthy competition” in the market.

Tariq Glass channeled BGL’s sales by procuring all of BGL’s production (total output) and then moving it forward. This arrangement was implemented because BGL was a non operational company, and channeling sales through TGL prevented BGL’s funds from getting stuck in distribution network development, thereby minimizing fund shortages. Once BGL is fully operational, it plans to develop its own distribution network over time

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.