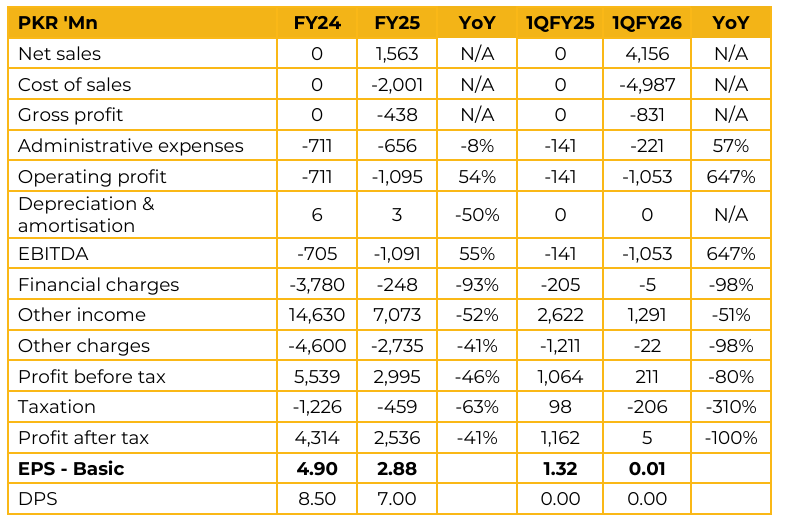

Kot Addu Power Company Limited (KAPCO) reported earnings per share of PKR 2.88 for FY25, compared to PKR 4.90 in FY24. Furthermore, in 1QFY26, the company reported earnings per share of PKR 0.01, compared to earnings per share of PKR 1.32 in the same period last year (SPLY).

Currently, the TPPA remains suspended due to certain regulatory issues however, the company has filed a review petition with NEPRA, and management is optimistic of a favorable outcome in the coming months. If approved, the KAPCO plant will be re inducted into the National PAR System for the next three years.

The company’s ROE remains firm at up to 25% of the load factor, while any additional return will depend on the dispatch factor. Moreover, any savings in O&M costs will be shared equally (50:50) between the company and the power purchaser. The company’s ROE in absolute terms stands at around 12–13% KAPCO and Fauji Foundation have jointly submitted a bid to acquire Pharaon Investment Group’s 84.06% stake in Attock Cement Pakistan Limited (ACPL).

If successful, each JV partner will acquire a 42.03% shareholding in ACPL’s issued and paid-up capital. Regarding the sale of the turbine, approximately 47% of the revenue has already been recognized in 1QFY25 accounts, with the transaction expected to be completed by February 2026. The buyer is currently in the process of lifting scrap from the site. The management has no immediate plans to sell the colony land.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.