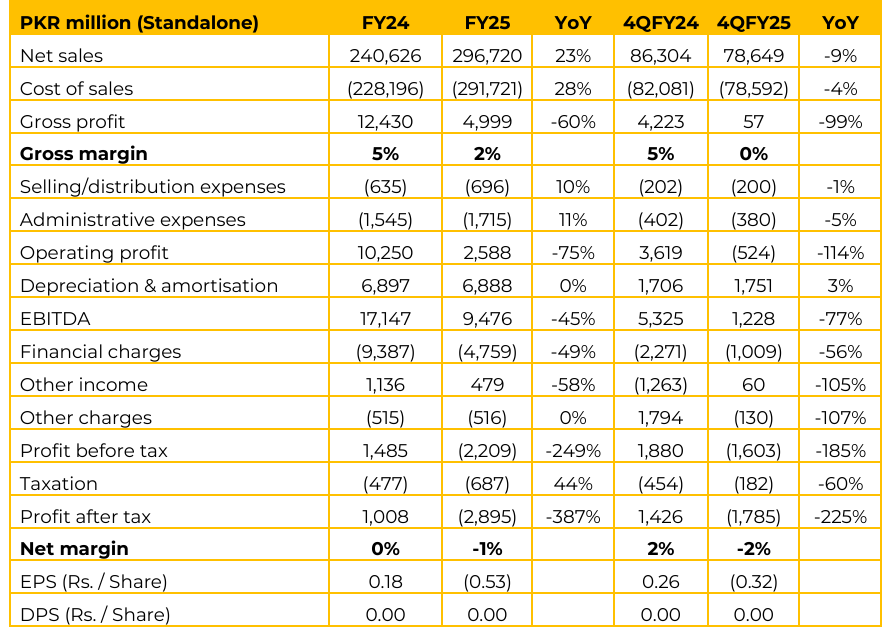

Cnergyico reported loss per share of PKR 0.53 for FY25 as compared to earnings per share of PKR 0.18 in SPLY. Furthermore, in 4QFY25, the company reported loss per share of PKR 0.32 as compared to earnings per share of PKR 0.26 in SPLY. For the first time, Cnergyico is importing crude oil from the United States.

The sailing time for US crude is approximately 35 to 40 days. The first cargo is expected to arrive soon, followed by the second on November 15th, and a third in January. The company’s strategy for the current fiscal year is to acquire lighter crude types (like West African or WTI implied).

This is done to minimize Fuel Oil (FO) production. For the last two years, the company has maintained a clear policy of price hedging. They hedge crude prices during the processing and selling period to ensure inventory gain/loss impact is minimized. Current throughput stands at 30-35%.

The budgeted throughput is around 60,000 barrels per day. The primary goal is to maintain the optimal throughput level that ensures profitability is maintained. Increasing throughput beyond this level (e.g., to 100,000 bpd) brings challenges in logistics, product disposal (especially given persistent product imports by other entities despite local production), and the risk of exchange/inventory losses from carrying excess inventory.

Despite challenges like fluctuating oil prices, smuggling, and intense competition leading to high discounts, the OMC business recorded a significant 34% increase in sales volume in FY25. In response to recent imposition of levies/taxes on furnace oil, the company has drastically increased exports. Currently, 90–95% of FO is being exported, with only 5% sold locally. The company is actively working on the upgrade project, which is estimated to cost around $1 billion. The sponsor is expected to arrange the major portion of the financing.

The project is divided into three phases:

1. Conversion of products to Euro 5 standards (work is currently in an advanced phase).

2. Fuel Oil Cracking to significantly reduce FO production to the minimum required for own consumption.

3. Increase in production of High Speed Diesel (HSD) and Premier Motor Gasoline (PMG).Implementation of the amended Oil Refinery Policy (2024) is pending due to issues concerning the Sales Tax exemption on petroleum products and the application of the Petroleum Levy (PL) and Climate Support Levy (CSL) on furnace oil. Discussions are ongoing with the government to resolve these issues to allow for the formal signing of upgrade agreements. A petition for the de-merger has been filed in the Sindh High Court (SHC). The next hearing is scheduled in coming few days. The de merger is expected to divide the current structure into six separate companies.

The company currently has six businesses operating within one listed entity. The de-merger aims to facilitate investments or partnerships by allowing specific investors or partners to enter a particular segment (e.g., logistics, OMC, or a specific refinery) without needing to invest in the entire corporate structure. The Government owes Cnergyico approximately PKR 57 billion in receivables, while Cnergyico owes the Government about PKR 47 billion (related mainly to the Petroleum Levy). This leaves a net delta of PKR 10 billion owed to the company. A settlement regarding the Petroleum Levy dues (pre-2023) has been approved by the ECC and is expected to be signed soon. SIFC (Special Investment Facilitation Council) has committed to facilitating this settlement.

The issue regarding bank guarantees versus undertakings for cargo clearance was temporarily solved by the Sindh government allowing clearance based on undertakings for 15 days, pending resolution by the Federal and Provincial Governments. The management noted that this issue did not significantly impact Cnergyico recently as they are based in Balochistan, where a related issue exists regarding cash stuck with the provincial government of Balochistan.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.