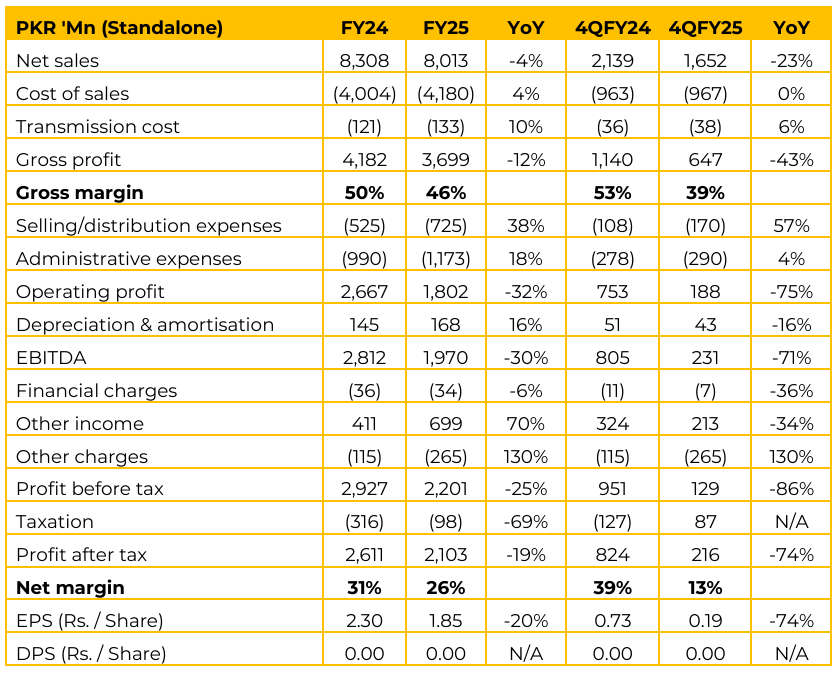

Hum Network Limited (HUMNL) reported earnings per share of PKR 1.85 for FY25 (FY24: 2.30). Furthermore, in 4QFY25, the company reported earnings per share of PKR 0.19 (4QFY24: 0.73). The decline in revenues was attributed to global and local advertising revenues decreasing due to the BDS campaign.

This decline impacted all major networks. The immediate decline in revenue in the last quarter was linked to war conditions, which caused almost all advertising in Pakistan to shut down, leading to a significant drop (from PKR 400-500 million in revenue to PKR 100-200 million).

The management emphasized that “Content is King,” which has been a proven strategy, evidenced by the channel rating number one in the entertainment segment. Although, the company continues to strengthen its digital footprint and sees digital growth becoming more robust than linear growth, the linear entertainment segment remains the biggest revenue area/sector for the network.

Recognizing the market migration from linear to digital, HUMNL is creating separate teams and producing new content specific to digital platforms (digital-only initiatives and podcasts). While immediate revenue is not expected from these digital initiatives, they will increase reach immediately. Revenue monetization is projected to ramp up in the next two years. The news segment has performed well even during tough times. Management hopes to generate more profits from the news segment this year. HUMNL is the lead partner in a large consortium project focused on gaming and animation. Partners include Huawei, 10s Game BCN, and other local entities.

The project aims to graduate 10,000 people over five years (5,000 in Karachi and 5,000 in Lahore). HUMNL’s direct income from the Ignite contract is primarily a management fee for acting as the lead manager. Management expects a nominal profit on their investment, and all investment made in the project will be recovered through the government contract.

The greater opportunity lies in the long-term potential for investing in the gaming and animation sector and driving significant exports. The company projects massive revenue potential, suggesting that if 10,000 trained people generate just $1,000 a month each, it could result in $10 million in monthly revenue. The company holds approximately PKR 1.54 billion in foreign currency cash in current accounts.

This large amount is held in a current account because it belongs to a subsidiary and is a repatriatable payable, which technically prevents it from being placed in a savings account. These funds are used for international payments for software or content (e.g., cricket series, payments to Sony). Utilizing these foreign holdings simplifies payments abroad, which is often difficult to execute directly from the home country. Going forward, the management plans to achieve a sustainable CAGR of roughly 20-25% in terms of growth in overall revenue and profitability, in-line with the long-term historical CAGR of the company.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.