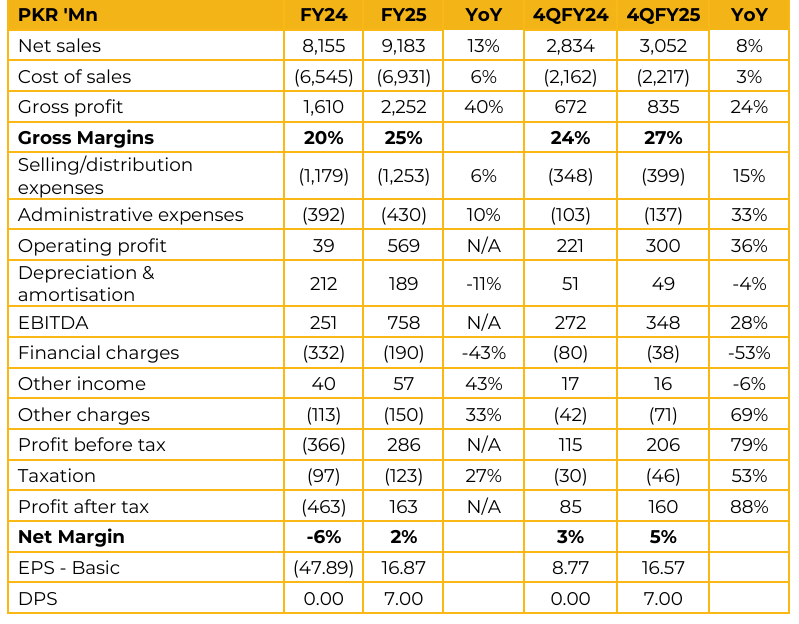

Shezan International Limited (SHEZ) reported earnings per share of PKR 16.87 for FY25, compared to loss per share of PKR 47.89 in FY24. Furthermore, in 4QFY25, the company reported earnings per share of PKR 16.57, compared to earnings per share of PKR 8.77 in the same period last year (SPLY). The fourth quarter is typically the best quarter, and volumetric growth in 4QFY25 resulted in increased Gross Profit (GP) margins.

Management hopes to maintain current gross margin levels, though they acknowledge margins vary quarter-to-quarter due to the seasonal nature of the industry. The start of the season (July) was good, but subsequent drops occurred due to floods and sudden weather changes in September/October. Management noted that the margins in Export are much better than local sales. Export increased from USD 3 million to USD 3.5 million this year. Management anticipates 10-15% growth in export sales (excluding PKR depreciation).

Growth was observed across various regions, including the UK, USA, Canada, and UAE. The most significant opportunities lie in countries with large Pakistani populations (UK, Canada, America, Australia, Saudi Arabia) due to the crave for nostalgic products. The company focuses on specific products that are not locally available in those markets, such as chili sauces. Ketchup, however, faces fierce competition from strong local brands abroad.

The export market demands greater variance than local markets. SHEZ introduces unique sauces made primarily for export. Canned Ready-to-eat items (Sarson ka Saag, Lahori Chanay) are also targeted at the labor class, particularly in the Middle East. New tariffs imposed by the US on Indian products present an opportunity. SHEZ is now entering products like Kesar Mango pulp to cater to the demand in American restaurants for items like mango lassi. SHEZ intends to improve its distribution network by increasing the number of distributors in key markets (e.g., aiming for four distributors instead of two in Canada).

Africa is currently not a focus, as it requires very low prices, and the region faces financial issues and intense competition from Bangladeshi and local brands.

The company reports having reach in all major metropolitan cities (Karachi, Lahore, Multan, etc.). Weak areas include some parts of Sindh and Karachi, where PepsiCo (Slice juices) are dominant competitors. SHEZ is particularly strong in Faisalabad and Gujranwala.

Management believes the local environment is shifting, with people increasingly moving towards domestic, localized brands, viewing them as being “as good” as multinational options. Market share of the company in Juices segments was reported to be around 15-20%. Juice and Drinks contribute 60-70% of the revenue. The 250 ml juice size is the single largest contributor to sales.

The current focus is on strengthening the existing product portfolio to recover pre-COVID/pre-FED volumes, rather than adding entirely new categories. The company intends to add new flavors within existing categories (e.g., sauces and ketchups) rather than diversifying into new segments. Entry into the carbonated drinks segment is not currently planned or under consideration. The distilled water plant came online, and the product was soft launched in April/May of the previous year. The distilled water plant came online, and the product was soft-launched in April/May of the previous year.

Production is currently limited to Lahore. The focus is exclusively on Lahore and surrounding areas. Going forward, the management does not anticipate any reduction in FED in the coming years and is focused on ensuring it does not increase.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.