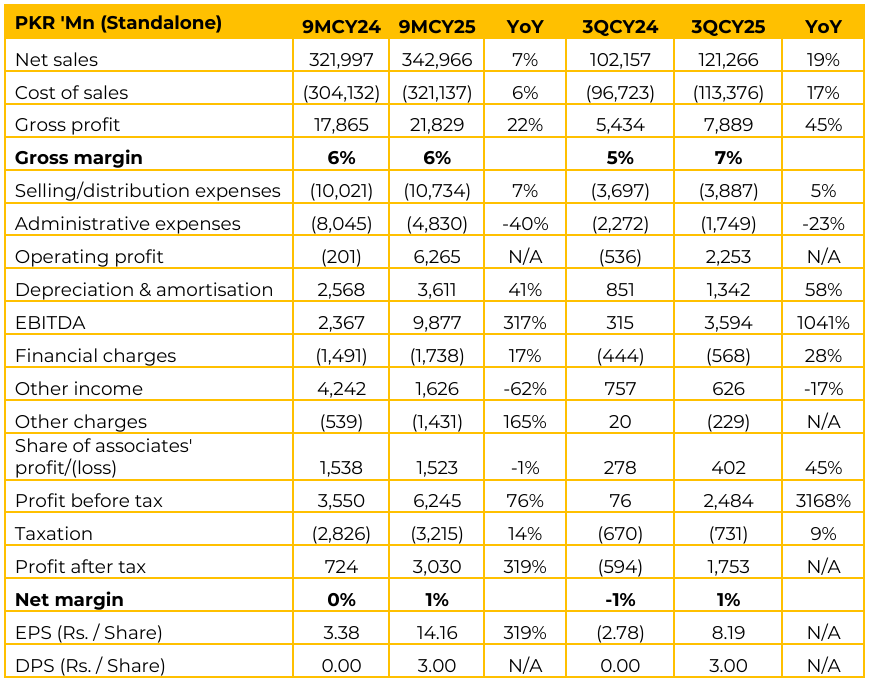

WAFI reported earnings per share of PKR 14.16 for 9MCY25 (9MCY24: 3.38). Furthermore, in 3QCY25, the company reported earnings per share of PKR 8.19 vs loss per share of PKR 2.78in 3QCY24. Year-to-date, the company has opened 28 new sites and plans to expand aggressively. It has also established a storage facility in KPK, providing capacity to support an additional 70–80 sites.

The company gained approximately 1% market share in the lubricant segment during 9MCY25, while motor fuel volumes grew by 8.5% YoY. Shell V-Power volumes surged by 155%, and inventory gains further boosted earnings in the recent quarter. Administrative costs declined significantly, primarily due to a reduction in group fees previously paid to Shell. Management highlighted that under Wafi Energy’s ownership, the company is empowered to pursue growth independently and make its own strategic decisions unlike under Shell, where expansion and capital expenditure were taken by the multinational.

The retail network currently comprises roughly 40% dealer operated and 60% company-operated sites. Previously, Shell managed supply arrangements now, the company can independently procure base oils and fuel from the most competitive suppliers. Regarding product sourcing, the company does not import diesel directly, while motor gasoline is sourced approximately 60% through imports and 40% locally.

Although no official figures were shared for lubricant volumes, management estimates the company’s market share to be above 20%, based on internal studies. On royalty payments, management stated that these would fall under SBP regulations. Discussing the E-mobility transition, management noted that the shift will likely be gradual, with no major change in fuel demand expected over the next 10–15 years.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.