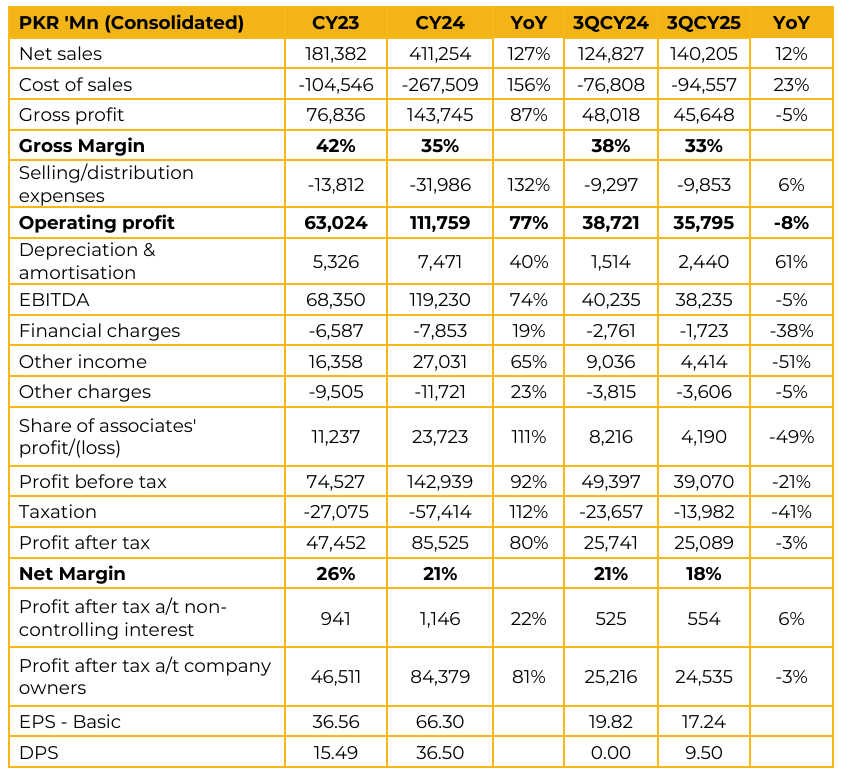

Fauji Fertilizer Company Limited (FFC) reported earnings per share of PKR 66.30 for CY24, compared to PKR 36.56 in CY23. Furthermore, in 3QCY25, the company reported earnings per share of PKR 17.24, compared to earnings per share of PKR 19.82 in the same period last year (SPLY).

As of September 2025, the company’s urea offtakes for the year stood at 1.95 KT, down from 2.22 KT in the SPLY. Meanwhile, DAP offtakes reached 541,000 tonnes, compared to 649,000 tonnes in SPLY. Management expects the urea market to rebound, noting that fertilizer application this year should surpass last year’s levels as farm economics continue to improve gradually. By the 1QCY26, management anticipates having around 270 Sona Centres operational.

These centres aim to ensure farmers have affordable access to fertilizers, offer free soil and water testing, provide satellite-based agronomic advisory, and extend non collateralized financing. Currently, 115 Sona Centres are active, and roughly 2% of total offtakes are being routed through this network.

The company has also made tangible progress toward becoming Shariah-compliant, with formal disclosure expected in the upcoming results. Management clarified that no discussions are currently underway with the government regarding potential urea exports. They expect full-year urea Industry offtakes to reach around 6.3 million tonnes, with year end inventory levels well below 1 mn tonnes. Fertilizer application is anticipated to remain strong in 4QCY25.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.