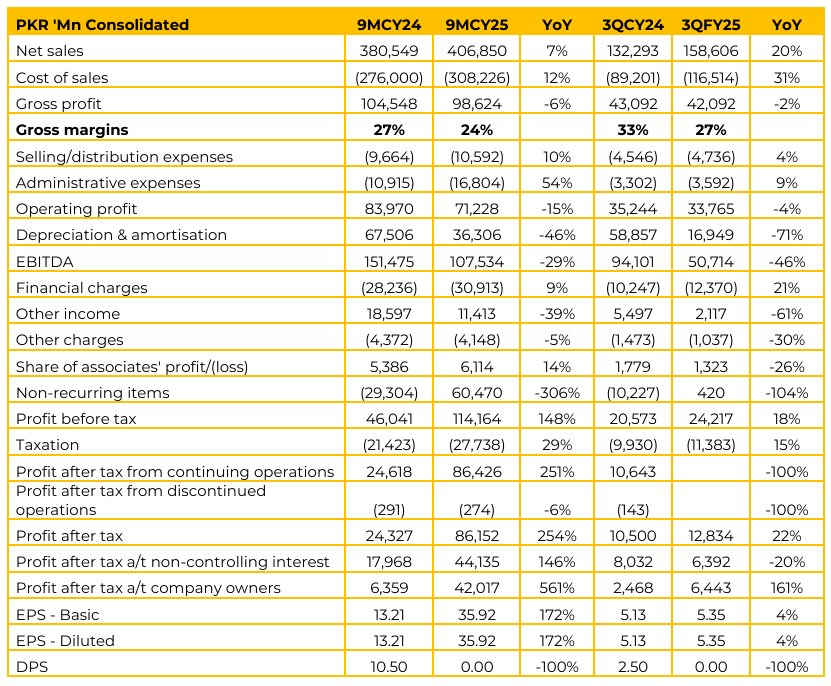

ENGROH has reported consolidated earnings per share of PKR 35.92 in 9MCY25 (9MCY24: PKR 13.21). Furthermore, in 3QCY25 the company reported EPS of PKR 5.35 (3QFY24 EPS: PKR 5.13). The management reiterated three major changes affecting the 2025 financial statements. One being that Engro Holding was formed and Engro Corp was delisted. The number of shares increased significantly from 481 million to 1.2 billion. This change must be noted when calculating Earnings Per Share (EPS) and owner share profit.

The termination of the Sales Purchase Agreement related to thermal assets resulted in a one-time significant profit after tax of roughly PKR 42 billion being booked. Energy profits will now be recognized regularly as a going concern/continued business rather than a discontinued business.

No material dividends are expected to be paid to Engro Holdings until December 2026, as Engro Corporation is purchasing the Deodar mega asset via installment payments. Analysts were reminded that the standalone portfolio has been moved to Dawood Hercules Partners Limited under the scheme of arrangement. About the Fertilizer business (EFERT), the management mentioned that the Urea volumes have been lower than last year. Discounts were given (by Engro and other players) to maintain market share due to a “long market”.

The company has still made a decent profitability of PKR 14 billion (although lower than last year, cash generation is healthy). Management sees signs of revival in offtake, driven by government intervention and farmer incentives/support seen in Q3/September/October.

They expect sales to pick up in Q4 (the Rabi season, which is critical for wheat). Management confirmed there is “very serious consideration” for a proposal involving dedicated gas field allocation for fertilizer players to secure food security. This initiative is long term and primarily aims to secure gas supply, making pricing a secondary factor.

Regarding Engro Polymers, management mentioned that the company is currently in losses. Profitability is being dragged down by very low international margins on PVC (driven by the international core delta), which are almost at a decade low. Management recognizes that cycles come and go in this commodity business and is focused on cash conservation.

Both the LNG terminal and connectivity businesses, defined as service businesses, are subject to the minimum tax regime, which has significantly increased their effective tax rates. For LNG Terminal, the tax rate increased from 9% to 15% of the top line. This rate is high enough to be greater than the normal 39% profit tax (29% tax + 10% super tax). This almost eats up 75% of the business’s profitability, which is deemed unsustainable. For connectivity business, the tax rate increased to 6% of the top line (from 4%).

This results in an effective tax rate touching close to 60%. Management noted that the effective tax rates might come down as a result of increase in the bottom-line profitability, as the effective tax is the higher of either minimum tax or normal tax regime. Management is actively taking up the issue with FBR and relevant ministries, arguing that these are industrial/high capital intensive, low-margin businesses, not professional services, and should be moved to a normal tax regime.

They are hopeful for reconsideration in the forthcoming budget. Regarding Deodar (Telecom/ Tower Business), company mentioned that the management control was acquired from June 3rd. The business is now a pillar of Engro. After four months of operation, it has started to generate cash, and performance is better than the initial feasibility. Management defended the acquisition price (USD 565 million for 10,500 towers) by noting that Engro bought only the tower portfolio with a long (25-36 year) contract for a rent-seeking business.

This differs fundamentally from PTCL’s acquisition of the entire telecom Pakistan business, which includes the US and real estate. Approximately 50% of the revenue from Jazz is dollarized. The contract also includes escalation elements tied to inflation, making the business secured against devaluation, inflation, and interest rate hikes.

5G rollout is anticipated but expected to be slow. It is seen as an opportunity (e.g., for small towers) and will help increase the portfolio size. The focus is on realizing operational efficiencies (security, fuel, maintenance) across the tower portfolio. Regarding Engro Energy, they mentioned that both operating IPPs and the mine have operated uninterrupted.

Profitability has seen a dip due to the renegotiated contract shifting from “take or pay” to “take and pay,” operating at around 50% capacity. Management is increasing efforts to find more fuel nearby, as every megawatt dispatched under the new contract directly helps the bottom line. Engro Powergen Qadirpur Limited is currently 69% owned. The company is keeping itself agile for monetization of EPQL (selling entire or partial ownership) if a good buyer is found. FrieslandCampina Engro Pakistan faces a primary challenge of the conversion from packaged milk to loose milk, which is hampered by sales tax disparity and other regimes.

The business maintains a very healthy market share (60%) within the packaged milk category. Management requested that users seeking better understanding of the financial complications (restructuring, accounting impacts, fair value adjustments, and specifically the taxation issues clarified during the Q&A) contact them offline for further clarification.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.