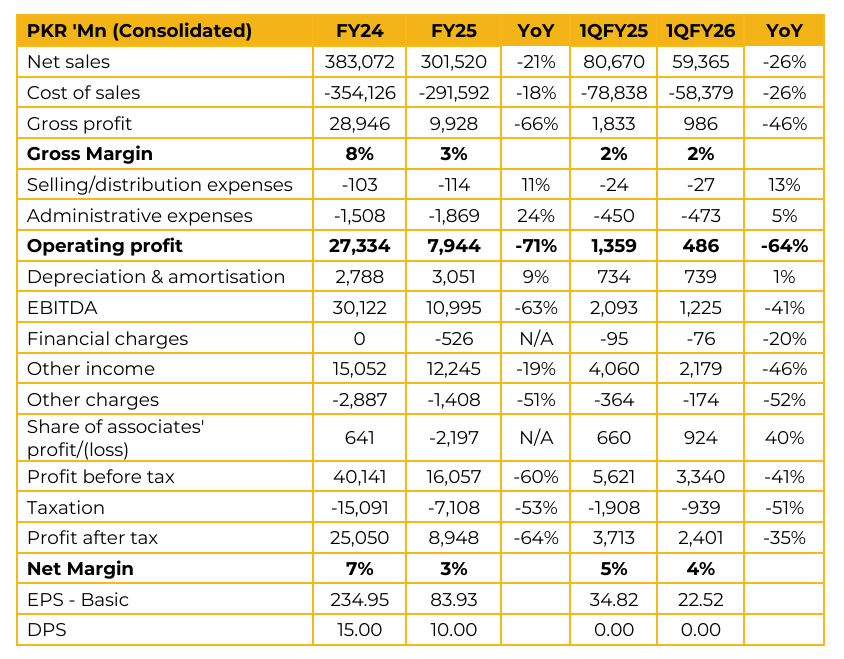

Attock Refinery Limited (ATRL) reported earnings per share of PKR 83.93 for FY25, compared to PKR 234.95 in FY24. Furthermore, in 1QFY26, the company reported earnings per share of PKR 22.52, compared to earnings per share of PKR 34.82 in the same period last year (SPLY). With a decline in local furnace oil consumption, the company has commenced exports, having already shipped approximately 137,880 tons of Furnace Fuel Oil. A Petroleum Levy and a Climate Support Levy have also been imposed on FFO.

The company has faced challenges in ensuring crude oil availability from the northern region. Although supply has recently improved, past shortages necessitated crude imports from the south, averaging around 15,000 barrels per day (bpd). The company is currently in discussions with a supplier to secure an additional 5,000 barrels of crude.

The refinery possesses the capacity to process heavier crude available in the southern region. It has submitted a proposal to the government seeking approval to import crude from the south, along with a request that the freight costs incurred in transporting crude to the north be compensated through the IFEM. The company’s designed throughput stands at 53,400 bpd. Its major customers include Attock Petroleum Limited (APL), contributing 30% of total sales, and Pakistan State Oil (PSO), accounting for 29%. As part of its upgradation initiative, the company plans to enhance Premium Motor Gasoline (PMG) production by 25% and reduce chemical costs.

The revamping of ARL’s Diesel Hydrodesulfurization (DHDS) unit will also enable the production of Euro-V compliant fuels. Under the sales tax exemption head, the company received PKR 3.4 billion during FY25 and PKR 600 million during 1QFY26. During 1QFY26, capacity utilization remained subdued, with throughput around 65%. Despite favorable Gross Refining Margins (GRMs), the company was unable to fully capitalize on them due to lower sales volumes. The company primarily processes lighter crude, with an average processing cost of about USD 7 per barrel. Furnace oil output remains relatively low at around 15% of total production. levy has also been implemented on supply of furnace oil to local IPPs.

Currently, the company enjoys a 7.5% duty advantage on diesel. Upon the signing of the upgradation project, it will gain a 10% duty retention advantage on both petrol and diesel.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.