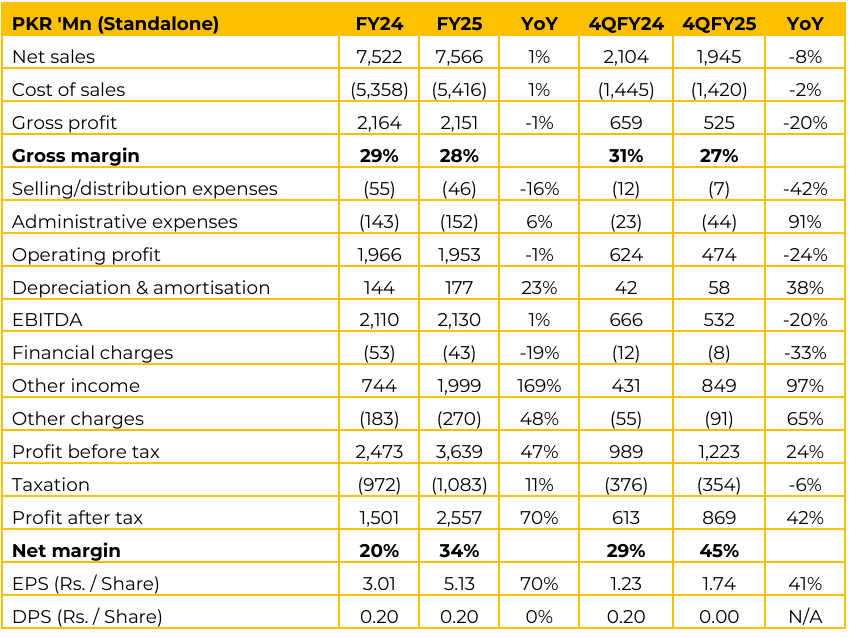

THCCL has reported standalone earnings per share of PKR 5.13 in FY25 (FY24: PKR 3.01). Furthermore, in 4QFY25 the company reported EPS of PKR 1.74 (4QFY24: PKR 1.23). While the maximum capacity (using imported coal) is 2,250 TPD, the use of local coal limits the operational capacity to 1,800 to 1,850 TPD. Daily clinker production is typically 1,650 to 1,700 tons, due to the age of the plant (1980s).

Monthly clinker production averages between 45,000 and 50,000 tons, which yields cement production after adding approximately 10% additives. Sales quantity was lower year-on-year and quarter-on-quarter in 1QFY26 (approximately 98,000–99,000 tons). This was caused by an attempt to introduce a new dealer system innovation that did not work well, necessitating a return to the old system.

The run rate improved significantly in October, with 49,000 tons sold as of the day before the briefing. Management is confident they are on track to achieve past results and expects to achieve prior run rates within six months. Management confirms the use of local coal for 3-4 years has not resulted in significant operational risks or plant damage. Maintenance costs have increased proportionally because production has increased. Thatta Power owned 88.52% by THCCL, operates as a captive power plant. It uses seven generators (23.1 MW), 5 MW solar, 4.8 MW wind turbine (recently commissioned), and a 4 MW Waste Heat Recovery (WHR) project.

Thatta Power recovered previous losses, reporting a PKR 352 million profit compared to a PKR 236 million loss in FY24. EPS improved from a PKR 4.93 loss to a PKR 7.36 profit. THCCL is currently buying power from the grid, not Thatta Power. Thatta Power operates under a Captive Policy and is subject to the recently imposed gas levy.

THCCL acquired 28% stake in Pakistan Services Limited. PSL manages a national chain of 2,000 hotels. Internal working forecasts a turnover of approximately PKR 17–18 billion. Expected bottom line (after taxes) is around PKR 4 to 4.25 billion.

Management highlighted that hospitality revenue is typically 95% generated from rooms (50%) and food and beverages (40-45%), with 5% coming from ancillary businesses (gyms, laundry, clubs). Room margins can be 85–90% based on international norms, but are slightly lower in Pakistan.

Minsk Work Tractors and Assembling (Pvt.) Limited (Belarussian Tractor Brand) – 100% owned by THCCL, is engaged in the assembling and sale of tractors. The paid-up capital is PKR 500 million. The company signed an exclusive agreement with the Belarusian company, granting THCCL assembly and local production rights in Pakistan. This exclusive arrangement is for 10 years. Initial attempts to import Complete Built Units (CBUs) faced challenges due to high tariffs, price wars, and a tough market (lowest tractor sales in 22-25 years). THCCL is moving from CBUs to Semi Knocked Down (SKD) and then Completely Knocked Down (CKD) kits.

This shift allows for the implementation of a deletion/localization program, which will improve margins and allow competition with local brands like Millat and Al-Ghazi. Currently importing 486 more CBU units. SKD kits expected to start arriving around February/March 2026. CKD kits expected to start arriving around July/August 2026. The full deletion program is anticipated to take 18–24 months. The group already has an existing assembly line through a sister entity (in Balochistan, producing tractors for export). Only a minor additional expense is required to adapt the line for Belarussian CKD units. No money needs to be invested in land or a new plant.

Margins will be low initially (on CBU imports) and are expected to improve continuously with every passing month as the deletion program progresses and the company moves to SKD and CKD kits. Going forward, THCCL has signed a Memorandum of Understanding (MOU) for a 5,000 TPD expansion line. This expansion will be a stand-alone line, running parallel to the existing plant.

The total capacity would reach 6,800 TPD (1,800 existing + 5,000 new). The new 6,000 TPD plant is estimated to take a minimum of 12 and a maximum of 14 months to construct once started, and it will run on local coal. Management intends to defer the start of the new expansion for at least six months to one year. This delay is necessary to consolidate the financial implications of the recent major acquisitions (PSL, Tractor arrangements) and generate further funds.

The company is focusing on increasing green energy levels. A 7.5 MW windmill (wind turbine) is being planned/worked on. THCCL was previously non-Sharia compliant because its interest income from banking deposits exceeded the maximum allowable threshold (5%, 6%, or 10% of total income). Total interest income for the previous year was PKR 482 million. As of 1QFY26, the company is fully compliant. The funds have been utilized for investments (PSL, other programs). Interest income for 1QFY26 was reduced to a nominal PKR 19 million.

The company has already opened Islamic accounts and is working to switch conventional bank accounts and mobilize deposits into Sharia-compliant banks. Stock exchange clearance for the compliant status will take time.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.