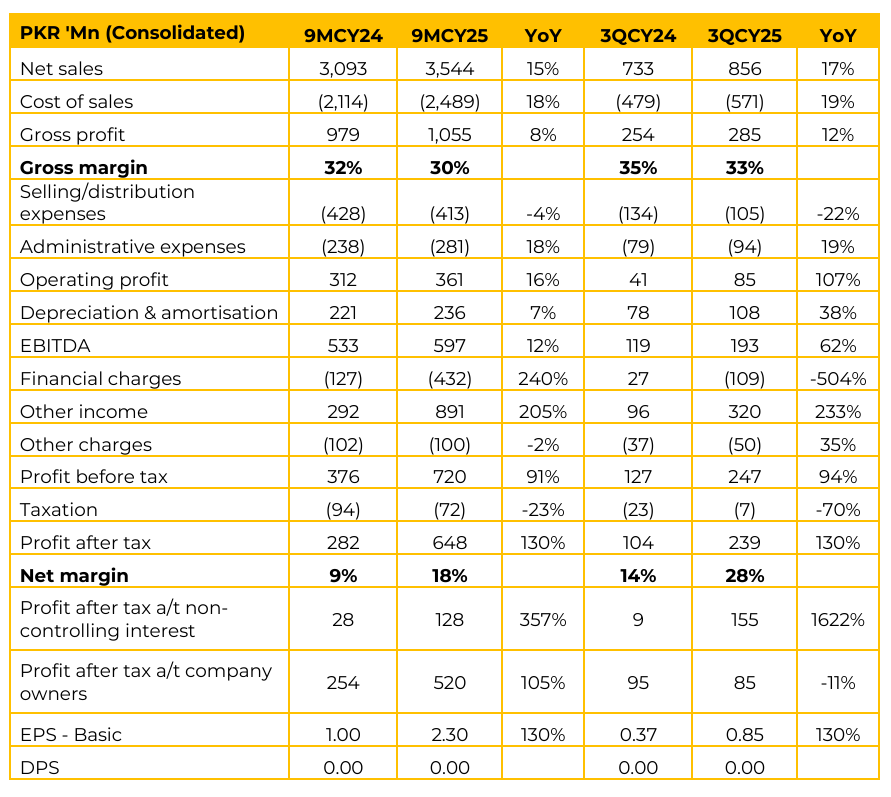

WAVES has reported consolidated earnings per share of PKR 2.30 in 9MCY25 (9MCY24: PKR 1.00). Furthermore, in 3QCY25 the company reported EPS of PKR 0.85 (3QCY24: PKR 0.37). Waves Corporation Limited (WAVES) is a holding company controlling three core businesses. Waves Home Appliances Limited (WAVESAPP) is a 50% owned subsidiary of WAVES.

WAVESAPP handles the appliances business, which includes flagship products like Deep Freezers along with Refrigerators, Air Conditioners, Washing Machines, Microwave Ovens, Water Dispensers, Gas Cookers, and Water Heaters. Waves Market Place a 100% owned subsidiary, is the retail arm. It operates approximately 100 retail shops. The business model primarily involves selling products on installment plans.

Products sold include WAVES branded items and other leading consumer appliance brands. The company boasts a strong recovery record, maintaining above 95% recovery even during the difficult economic periods of the last three to four years, attributed to committed customers and strong credit control procedures. Waves Builders & Developers Private Limited a 100% owned subsidiary, is a Real Estate business. This potential project is currently represented by land held on the Waves Corporation balance sheet.

The land is strategically located at the original factory site in Lahore, near Thokar Niaz Baig, on Multan Road. This area is a key entrance point for traffic and wholesalers across Punjab. The real estate project concept involves a mixed-use facility, including potential development for a wholesale market, educational institutions, hospitals, or small commercial plotting. A significant component is Affordable Housing.

This is viewed as a unique offering because affordable multi-storied housing in Lahore is generally unavailable within the city core (it is usually in the suburbs), allowing residents to work within the city. Proximity to the Orange Line is an added benefit.

The Lahore property (on the holding company’s balance sheet) has a book value of approximately PKR 3.8 billion. Management stressed that the current book value is highly conservative. The recorded book value is 25% to 30% less than the DC (District Collector) rates, despite market values usually being much higher than DC rates.

The project was conceived three years ago but was deferred due to slowing real estate market conditions, particularly the withdrawal of subsidized housing loans and the slow pace of general market activity. In Deep Freezers, Waves is a market leader. The market is divided into dealer network sales and corporate clients (e.g., large beverage/food companies like Coca-Cola, KN&N, Sabroso, Fauji Foods).

The overall 5-year average market share for deep freezers has been around 40%. At one point, WAVES held 70 80% of the corporate market share. In Refrigerators, the market share is currently in single digits. However, the product range is comparable to any large company, and significant growth is anticipated in the coming years. Due to monetary tightening in the last two years, some products (including ACs, which are often imported/assembled on a CKD basis) were discontinued.

The company is now in the process of re-launching these products to capture the potential the brand enjoys. Air conditioners are expected to restart supply in the next couple of months. They expect a positive effect on results in the coming calendar year.

Management emphasized that “Other Income” has been a significant component of earnings. This income is derived mainly from two sources:

1. Unrealized Gain on Real Estate Assets: Gains were recorded on the appreciation in value of two properties: the holding company’s land (Multan Road) and the new factory land acquired by Waves Home Appliances. This gain was booked carefully and conservatively. Management aims to book this gain gradually rather than in one large entry to avoid a “one-off” effect and allow for a potentially recurring effect in future periods.

2. Gain from Loan Restructuring: A gain was booked according to accounting principles resulting from the deferment of accumulated and recurring financial charges associated with approved bank loan restructuring programs. Restructuring has been approved for roughly half of the total loans. The gain related to the remaining loans will be booked upon their final approval.

Regarding the land, significant interest has been shown by large developers/investors for outright purchase, though they have paused final offers due to slow sales conditions of housing-units nationally. Going forward, despite having the plans to develop project on the land, the management appeared to be more inclined towards outright sale, given the slow economic landscape. Unrealized gains will be booked gradually in other income.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.