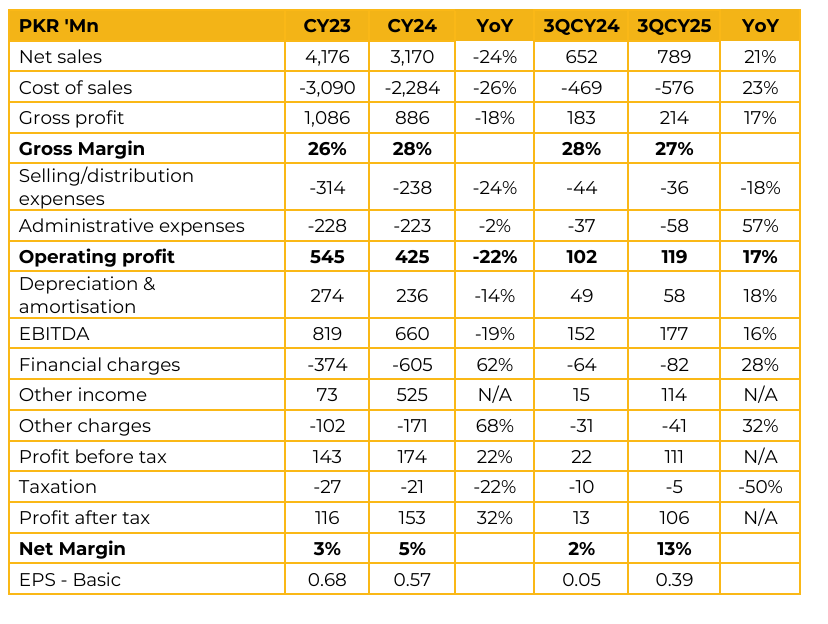

Waves Home Appliances Limited (WAVESAPP) reported earnings per share of PKR 0.57 for CY24, compared to PKR 0.68 in CY23. Furthermore, in 3QCY25, the company reported earnings per share of PKR 0.39, compared to earnings per share of PKR 0.05 in the same period last year (SPLY).

The appliance market in Pakistan is valued at PKR 750bn, led by refrigerators (PKR 230bn) and air conditioners (PKR 190bn). Waves lead the deep freezer segment, catering to both retail and corporate customers. Its refrigerator line spans five widths, covering most market needs, while ACs, washing machines, and microwaves will be relaunched under a CKD model. The company also makes geysers and plans to revive water dispensers soon.

Management targets to grow sales from PKR 5bn to PKR 25bn in 2–3 years, driven by re-entry into CKD-based categories. Even a 5% share in the 1.2–1.5mn-unit AC market could meaningfully lift sales. The clean balance sheet structure positions Waves well for potential foreign joint ventures or acquisitions, with several MNCs showing interest post-US tariff shifts. The company exports refrigerators and freezers to Afghanistan, though shipments have been temporarily paused in recent weeks due to the prevailing war-like situation.

The company has partially booked the unrealised gain on its Kasur land, whose market value is estimated at nearly four times the book value. This gain is being recognized gradually and conservatively rather than as a one-off. Additionally, loan restructuring gains also contributed to other income. Appliance demand is increasingly shifting toward larger, higher end products. This has resulted in topline growth in value terms, while volumes have remained broadly stable. To drive retail penetration, Waves plans to expand installment based sales via its 100%-owned Waves Marketplace, serving 400k customers, and is exploring a consumer financing partnership or bank tie-up.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.