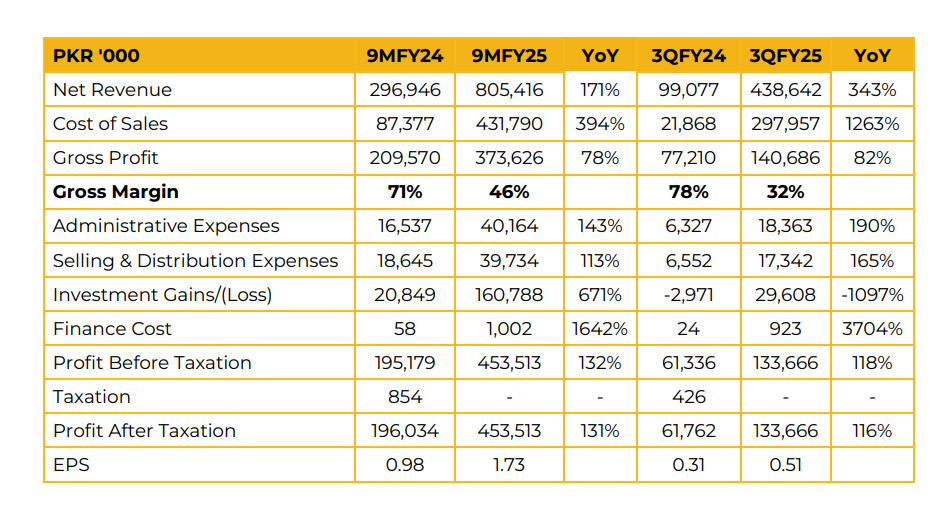

Zarea Limited posted a net profit of PKR 453.51 million (EPS: PKR 1.73) in 9MFY25, up sharply from PKR 196.03 million (EPS: PKR 0.98) in the SPLY. This growth was supported by a strong increase in revenue, which rose to PKR 805.42 million from PKR 296.95 million in SPLY.

The company earns revenue through two key streams: platform usage fees of PKR 294 million, which incur the lowest fixed cost, and agri-biomass sales of PKR 500 million. Revenue and profit CAGRs stood at 207% and 233%, respectively, with return on equity recorded at 22%. Zarea reported more than 17,000 transactions across 50 cities and executed 250,000 metric tons in traded volume, serving over 20 industries.

The company operates in marketplace services, import/export, data analytics, and logistics & warehousing. As of March 31, 2025, unutilized IPO proceeds stood at PKR 942.5 million. The breakdown includes PKR 38.24 million allocated to working capital, PKR 2.20 million to technology, PKR 3.25 million to marketing, PKR 1.06 million to office capex and vehicles, and PKR 1.37 million to human capital. So far, PKR 45 million (4% of the total) has been spent, with the remainder expected to be utilized over the next three quarters. According to management, Zarea currently trades at a P/E of 6.81x—an 82% discount to the PSX tech sector average of 37.92x.

Despite this, the company maintains one of the highest ROEs in the sector. Al-Hilal Shariah Advisors (Pvt.) Ltd. has declared the company Shariah-compliant. The company has added new commodities to its platform, including coal, fertilizers, and chemicals, and is in the process of establishing an Import Division to source industrial materials, backed by a PKR 200 million LC facility. It has begun exporting agri-products like corn and Rhodes grass, aiming to generate USD 10 million in export revenue over the next three years. The first Rhodes grass consignment has already been shipped to the UAE.

To support logistics, an inhouse delivery network is being developed to improve operational efficiency. Zarea is also entering value-added processing, including bailing, thrashing, and packaging for products such as corn silage and agri-biomass. It plans to set up collection centers across key agricultural regions in Punjab and KPK, with four already established in Punjab.

Additionally, the company is upgrading its digital platform to improve functionality and user experience. Looking ahead, management plans to launch 12 new commodity categories over the coming quarters, including agri-perishables, sugar, chemicals, cotton & yarn, and grains & pulses. Zarea is targeting just 1% of Pakistan’s USD 20 billion commodities market within 5–7 years. It targets 45– 48% of its future revenue from renewable energy. For FY25, revenue growth is projected at 140%, followed by 120–130% in FY26, with bottom-line growth expected to remain in line. Management also aims to distribute dividends in the range of 20–30%.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.