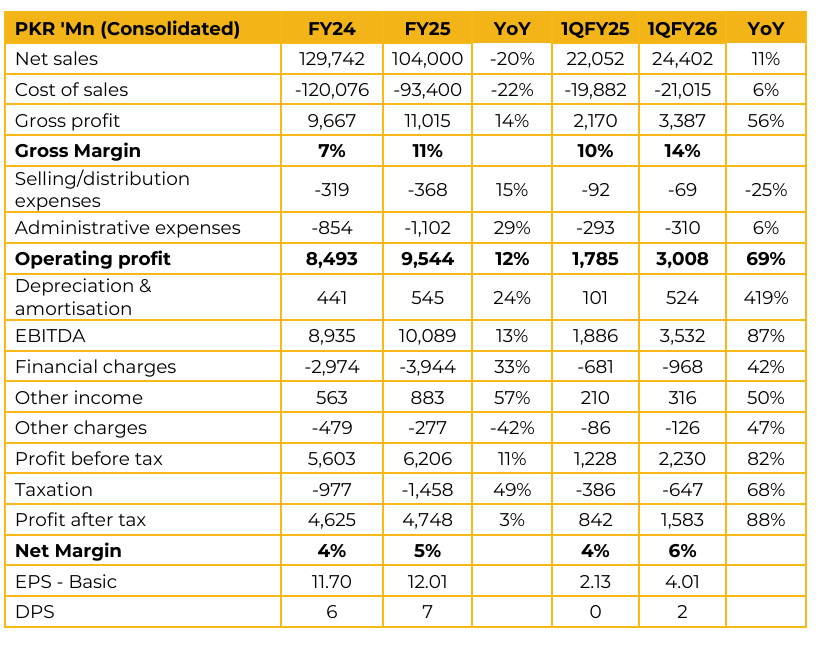

Air Link Communication Limited (AIRLINK) reported earnings per share of PKR 12.01 for FY25, compared to PKR 11.70 in FY24. Furthermore, in 4QFY25, the company reported earnings per share of PKR 4.01, compared to earnings per share of PKR 2.13 in the same period last year (SPLY).

The company plans to enhance its production capacity through its Sundar facility. Mobile phone production will be carried out at both plant locations, while the first shipment of tablets is expected to arrive in November. In FY26, management plans to sell approximately 100,000 laptop units. Regarding overall production, they expect to manufacture around 2.5–2.6 million units during the year.

For the upcoming year, they project revenue contributions of around PKR 8 bn from televisions, PKR 2–4 billion from laptops, and an additional PKR 10 15 billion from enhanced production across both Xiaomi and Airlink. Total sales for the year are expected to reach approximately PKR 140 billion. Management also indicated that gross margins are likely to remain stable at current levels. Retail presence in Pakistan continues to expand. In FY24, retail revenue was PKR 1.1 billion, which increased to around PKR 2 billion in FY25, and a similar growth trajectory is expected in the coming years. In terms of retail expansion, the company has secured three prime locations in Lahore.

The Samsung store at Dolmen Mall is already operational, a Xiaomi store will open in November, and Pakistan’s first iPhone monostore is scheduled to launch in December. Regarding Xiaomi’s potential car import, management stated that they will first cater local the left-hand drive markets’ requirements. They are also in discussions with several manufacturers, adding that any entry into this segment would be through a joint venture. In the white goods segment, the company expects to finalize agreements with Chinese manufacturers by the first quarter of the CY.

These products will be marketed through existing dealer networks. The decline in costs was primarily attributed to successful negotiations with principals and a shift in sales mix. Management expects these cost savings to continue in the coming years. They also highlighted that competing in export markets remains challenging without the support of government rebates.

The Sundar plant will benefit from corporate and super tax exemptions. As for the new factory, management plans to finance it through internal resources and will approach banks for funding only if required.

Management also anticipates improved sales with the stabilization of wheat prices. They noted that the recent war had caused a one-month supply disruption, which temporarily affected revenues.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.