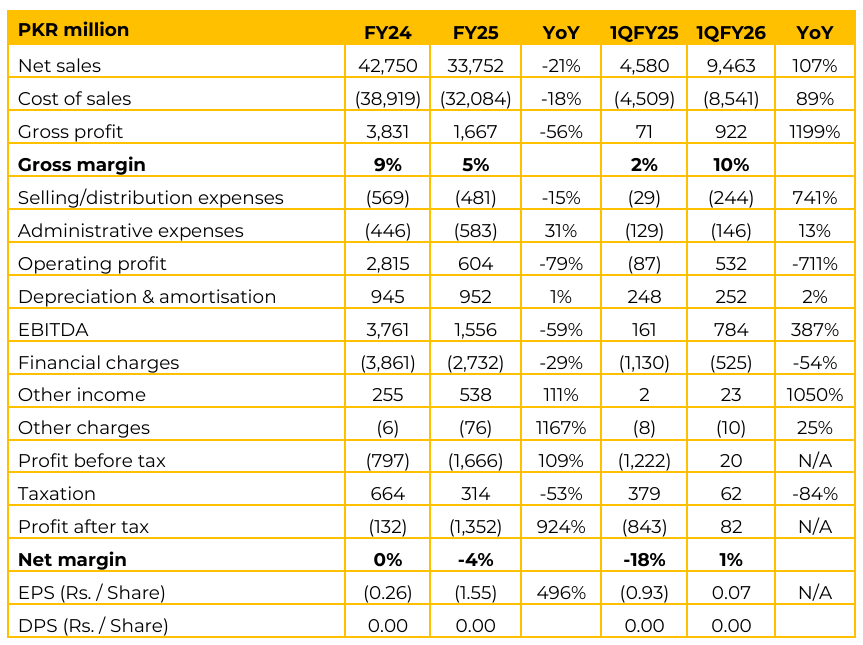

ASL has reported loss per share of PKR 1.55 in FY25 (LPS FY24: PKR 0.26). Furthermore, in 1QFY26 the company reported EPS of PKR 0.07 (LPS 1QFY25: PKR 0.93). ASL ended in a loss of PKR 1.3 billion in FY25. This loss was primarily due to low volume, which prevented sufficient gross margin generation to cover costs. Capacity utilization stood at 25%. The company expects to achieve 30-35% utilization by the end of FY26.

This roughly translates to 210,000 – 245,000 tons of production. The company is aiming to produce similar volumes that it would sell. Exports are expected to be substantially higher this year. Last year, exports were around 25,000 tons; this year, the target is higher than 50,000 tons.

Management highlighted that whenever the NTC imposes a duty, importers typically seek stay orders from courts, which they often obtain easily. ASL must then challenge these stays at the tribunal. Importers use the time provided by the stay order to clear their material. ASL is challenging the practice of customs authorities accepting Post Dated Checks (PDC) instead of tangible guarantees (like a pay order or bank guarantee) for disputed duties.

Management believes the specific current case will be vacated in the next hearing within two weeks, though the overall legal battle is ongoing. Management is hopeful of better financial results, regardless of the legal battle which is never ending. ASL attributes ISL’s better performance primarily to their strength in Original Equipment Manufacturers (OEMs). ISL has an in-house service center (for cut-to-size/length and slitted products), which is a key value-added sector. ASL relies on external service centers, which are more costly and time consuming.

ASL is now focusing more aggressively on OEMs. Electricity cost is 4–5% of the Cost of Goods Sold. ASL uses about 100 units per ton, significantly less than melters (600–700 units/ton). ASL is planning to set up a 2 MW solar project during the current financial year to reduce energy costs, though this is primarily useful during the daytime

Going forward, the management is hopeful for some improvement in market share and sales volume, since imports to FATA/PATA are now subject to a 10% sales tax, which will gradually increase to 18% over five years. ASL successfully advocated to the NTC regarding the misdeclaration of Galvalume and ZAM. Anti-dumping duty has been implemented on Galvalume, ZAM, and other likely coated materials from the current financial year. However, the legal battle will continue. CRC is primarily sold to automative sector (up to 75% of CRC Sales).

GI has a wide application base, including white goods, general engineering, housing, ducting, and is partially dependent on the construction sector.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.