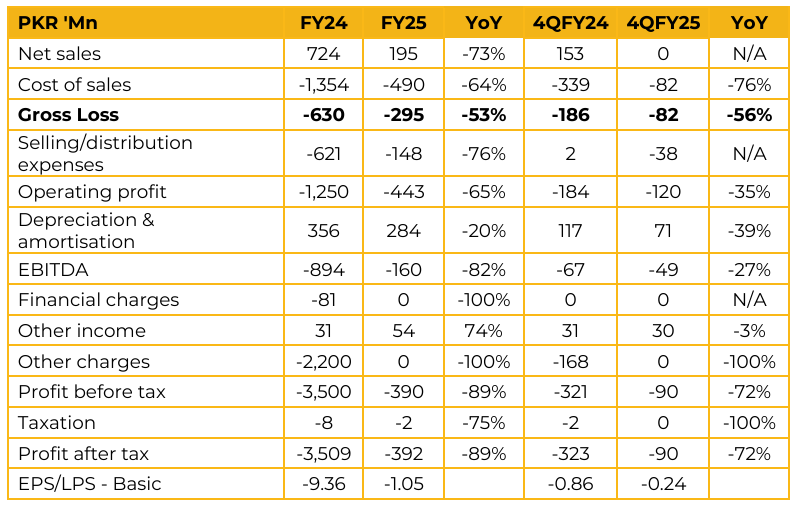

Al-Shaheer Corporation Limited (ASC) reported loss per share of PKR 1.05 for FY25, compared to PKR 9.36 in FY24. Furthermore, in 4QFY25, the company reported loss per share of PKR 0.24, compared to loss per share of PKR 0.86 in the same period last year (SPLY).

Earlier, the company’s bank accounts were seized however, banks have now begun allowing access. As of now, five banks have permitted the company to operate its accounts, while the remaining institutions are conducting due diligence, which is expected to conclude within the next couple of weeks. At present, the company’s major capacity utilization is being driven by the Red Meat and Value-Added segments, while White Meat is expected to contribute from the second half of the current fiscal year.

The company is targeting an overall capacity utilization of 40–50% within the next two years, supported by B2B contracts and expanding export opportunities. During the AGM, shareholders elected an independent board to appoint a new management team tasked with overseeing the reform process, including regulatory matters. Going forward, the management structure is expected to be revamped within the next 6–8 months, with experienced professionals brought in to strengthen business operations.

According to management, all technical requirements have now been completed, including the final step of conducting CBS. The global halal meat market is valued at USD 1.05 trillion in 2025 and is projected to reach USD 1.51 trillion by 2030, reflecting a CAGR of 2.56% over the period.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.