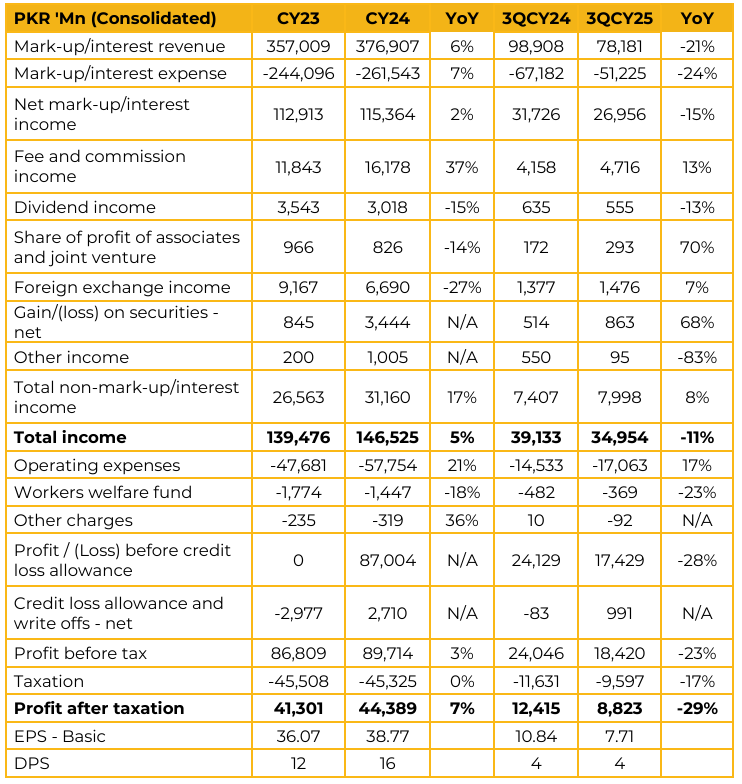

Allied Bank Limited (ABL) reported consolidated earnings per share of PKR 38.77 for CY24, compared to PKR 36.07 in CY23. Furthermore, in 3QCY25, the company reported earnings per share of PKR 7.71, compared to earnings per share of PKR 10.84 in the same period last year (SPLY).

The bank’s deposits stood at PKR 2,230 billion as of September 30, 2025, compared to PKR 2,018 billion as of December 31, 2024. Within this, current deposits amounted to PKR 858 billion. Industry deposits grew by 12%, while the bank’s deposits rose by 10%, reflecting management’s strategic focus not merely on expanding the deposit base but on enhancing the mix toward low cost deposits.

The bank’s investment portfolio comprises approximately 70% floating-rate PIBs and 30% fixed-rate PIBs, with the fixed portion carrying an average rate of 12.5%. The weighted average spread on floating PIBs ranges between 11.24% and 12.88%. Going forward, the bank aims to increase low-cost deposits and expand non-interest income streams, while maintaining deposit growth broadly in line with the industry.

According to management, credit offtake across the industry remains subdued, though a modest recovery is expected by December. The advances-to-deposit ratio is projected to remain in the 30–35% range. Management further expects a 100–200 bps reduction in the policy rate during 1QCY26, and added that there has been no adverse impact on asset quality due to recent floods.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.