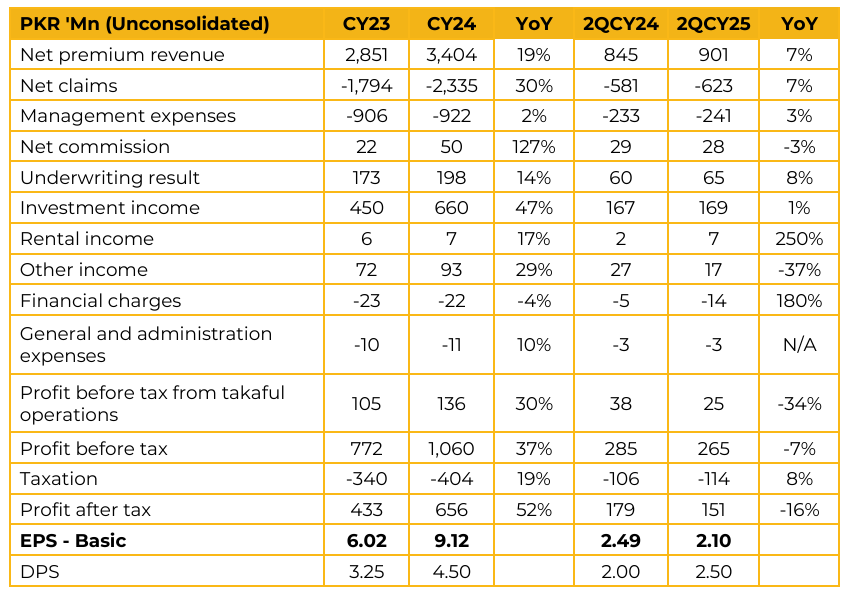

Askari General Insurance Company Limited (AGIC) reported earnings per share of PKR 9.12 for CY24, compared to PKR 6.02 in CY23. Furthermore, in 2QCY25, the company reported earnings per share of PKR 2.10, compared to earnings per share of PKR 2.49 in the same period last year (SPLY). During HY25, gross premiums expanded meaningfully in several lines of business. Fire segment premiums grew by 38%,

Health by 32%, and Motor by 11%. In contrast, the Marine segment contracted from 26%, while Miscellaneous segment by 11%. For HY25, profit before tax (PBT) stood at PKR 551mn, of which PKR 423mn was contributed by investments and other income, while the remaining PKR 127mn stemmed from operations.

Underwriting income improved by 10% to PKR 98mn. Simultaneously, investment income posted a robust increase of 23%, underscoring strong portfolio returns. The portfolio composition in HY25 was led by Health with a 43% share, followed by Motor (22%), Fire (19%),

Miscellaneous (11%), and Marine (5%). SECP has mandated higher minimum paid-up capital requirements for insurance companies of PKR 1bn by 2026, PKR 1.5bn by 2028, and PKR 2bn by 2030. The company has reported claims arising from recent floods. While the actual claim volume is awaited, management expects these to remain within a manageable range.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.