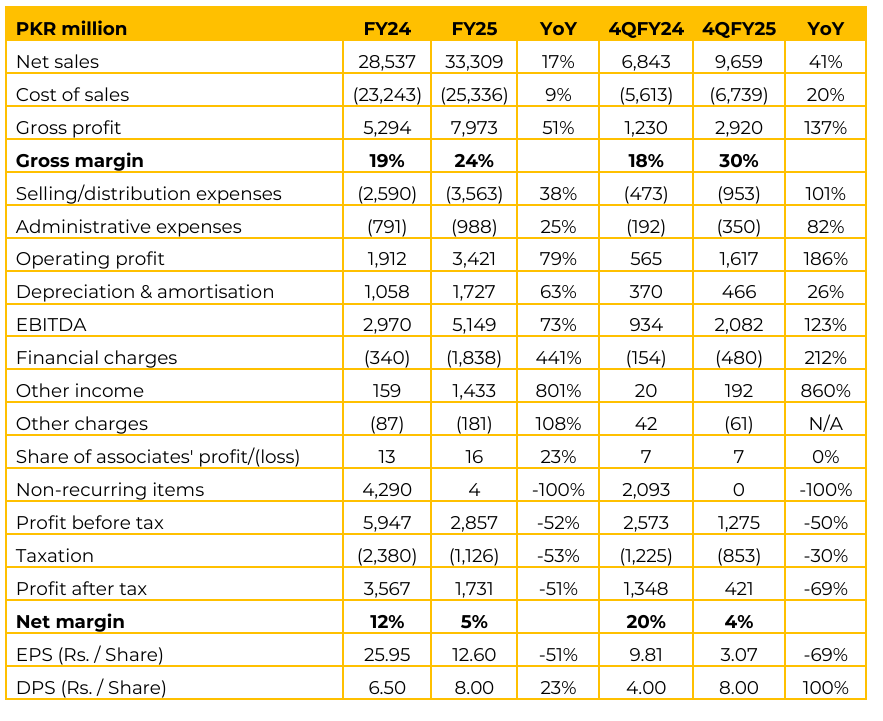

Attock Cement Pakistan Limited (ACPL) reported earnings per share of PKR 25.95 for FY25 (FY24: 12.60). Furthermore, in 4QFY25, the company reported earnings per share of PKR 9.81 (4QFY24: 3.07). Overall production cost saw a reduction of approximately Rs 800 per ton. Fuel cost reduced by 8% due to decline in international coal prices. Power cost decreased by 40% mainly due to enhancement in company’s own power generation capacity through the induction of 9-10 MW of CFB annexed with Line 4 and newly commissioned 4.8 MW wind power plant.

Clinker production was 2,801,955 tons (up 18%) compared to FY 2024, mainly because Line 4 became fully operational. Overall plant capacity utilization was 55% in FY25 (FY24: 54%). Management prioritized the more efficient Line 4 and Line 3 for production, keeping the less efficient Line 1 and Line 2 on standby.

ACPL’s local dispatches in FY25 decreased by 1% in FY25 to 1,223,875 MT (FY24: 1,239,154 MT), which was better than the overall reduction seen in the South Market (4.6% reduction). However, export dispatches increased by 41% in FY25. Local sales retention was approximately PKR 15,570 per ton (after subtracting sales tax and government levies). This retention was approximately 10% higher than the previous year.

During FY25, export retention was PKR 9,258/MT, 1.25% lower due to the competitive market. ACPL has significantly reduced its dependency on grid electricity. The overall power mix for FY 2025 is: CFB (Coal Fired Boiler): 37%, Waste Heat Recovery (WHRS): 34%, Solar (installed in 2024): 17%, Wind Mill (newly commissioned): 2%, K-Electric: 10%.

The proceeds from the profitable sale of the Iraq plant were utilized specifically for funding the installation of Line 4. The Iraq plant was a separate unit designed for local grinding and production (local market focus), not serving as an export platform from Pakistan. The sale was highly profitable, generating double the investment within five years. Going forward, the management expects local demand to improve by 5-7% due to the revival in construction and infrastructure activity. While, export growth is expected to remain in double digits if freight and energy costs stay moderate.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.