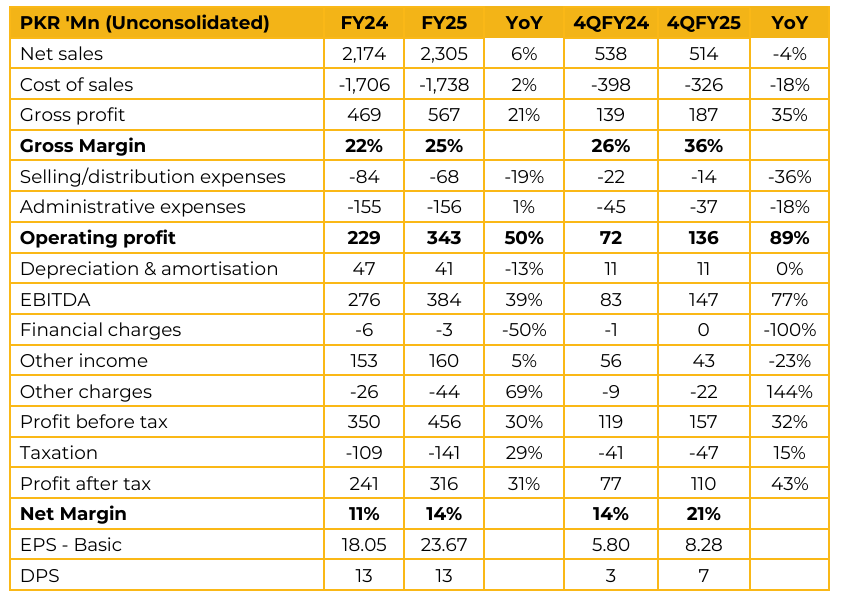

Baluchistan Wheels Limited (BWHL) reported earnings per share of PKR 23.67 for FY25, compared to PKR 18.05 in FY24. Furthermore, in 4QFY25, the company reported earnings per share of PKR 8.28, compared to earnings per share of PKR 5.80 in the same period last year (SPLY).

The company highlighted that it has no contribution in EV sales, as alloy wheels are used in that segment whereas it exclusively manufactures steel wheels. Management further added that, at present, they have no plans to enter the alloy wheel market. Currently, 99% of sales are generated through OEMs, with negligible volumes in the replacement market. Regarding Belarus tractors, management clarified that these are imported in CKD form and therefore provide no additional contribution to the company’s sales.

They also highlighted that Belarus tractors are unlikely to pose a significant threat, given that only about 1,000 units are imported annually. For the tractor segment, the company expects industry sales to fall in the range of 30,000–35,000 units. However, they emphasized that after fully assessing the impact of recent floods, they would be in a better position to provide a more precise outlook. In FY25, the company’s total sales stood at 281,703 units in the car segment, 33,324 units in trucks, and 35,616 units in tractors. The truck segment posted strong YoY growth of 71%, while the car segment registered a growth of 41% during the year.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.