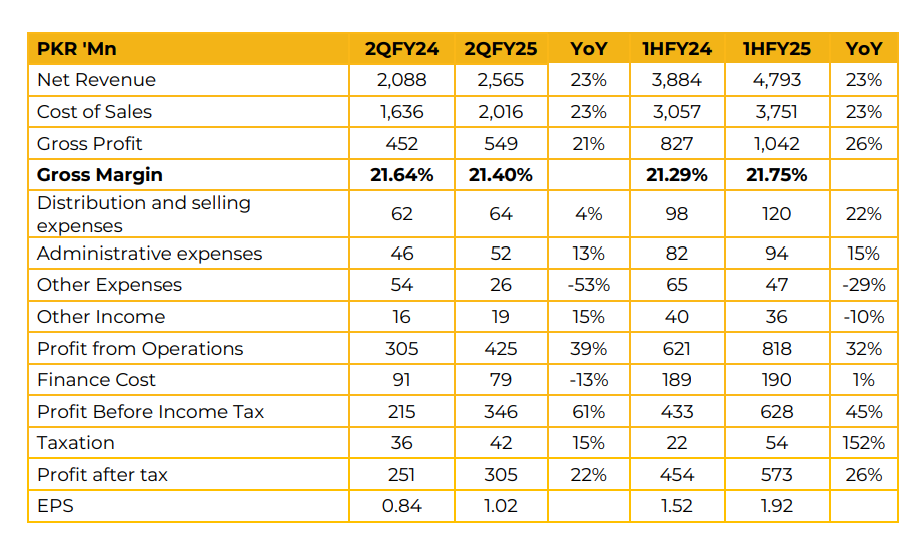

In 1HFY25, BBFL reported a net profit of PKR 573.43 million (EPS: PKR 1.92), reflecting a 26% YoY increase from PKR 454.16 million (EPS: PKR 1.52) in the same period last year. The improvement in profitability was driven by higher sales volumes and cost-cutting initiatives.

Revenue grew by 23% YoY, with 15% attributed to volumetric growth as sales increased from 6.9 million tons to 8 million tons, while the remaining 8% was inflationary. Gross margins remained stable at 21%, supported by hedging, indexing, and other cost-saving measures. BBFL is focusing on increasing the share of its retail segment due to the higher margins associated with value-added products compared to the corporate segment, where margins are relatively lower. In this regard, the company is in the advanced stages of securing a contract with Pakistan’s largest retail business.

The corporate segment’s revenue share contracted from 51% at the beginning of 2024 to 28% by year-end. The company reduced debt by PKR 559 million, primarily repaying liabilities to Saudi Pak Industrial and Agricultural Investment Company Limited (SAPICO). BBFL expanded its production capacity by 55MT, increasing total capacity from 120MT to 175MT in response to a market size of 200MT.

Management expects additional revenue of PKR 500 million from this expansion. Price volatility remains a key challenge, which the company has mitigated through hedging and indexing.

Capacity utilization currently stands at 30%, presenting an opportunity to achieve a targeted revenue of PKR 55 billion by 2030, by optimizing working capital requirements without additional capital expenditure. BBFL serves approximately 300 corporate customers, with McDonald’s contributing 17-18% of total chicken sales. BBFL’s own B2C segment accounts for 7-8%. Processed food contributes 3-4% to total sales, with further processing (FPP) accounting for 25% of total volume and primary processing (PP) representing 75%.

Marinated chicken remains a key sales driver, with “Yummy Drummy” contributing 15% of sales at select outlets. “Juicy Tenders” is also among the top-performing products. Quarterly sales in 2024 were reported at PKR 1.56 billion, PKR 1.76 billion, PKR 2.23 billion, and PKR 2.57 billion, showing a consistent upward trend. BBFL holds a 20-25% share in Pakistan’s PKR 200 billion chicken market.

The company currently exports meat to Qatar, Oman, Saudi Arabia, and Hong Kong. Looking ahead, BBFL plans to expand its retail and seafood segments while exploring further export opportunities.

Discussions are underway with global food chains and government bodies, alongside plans to strengthen the company’s own retail network

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.