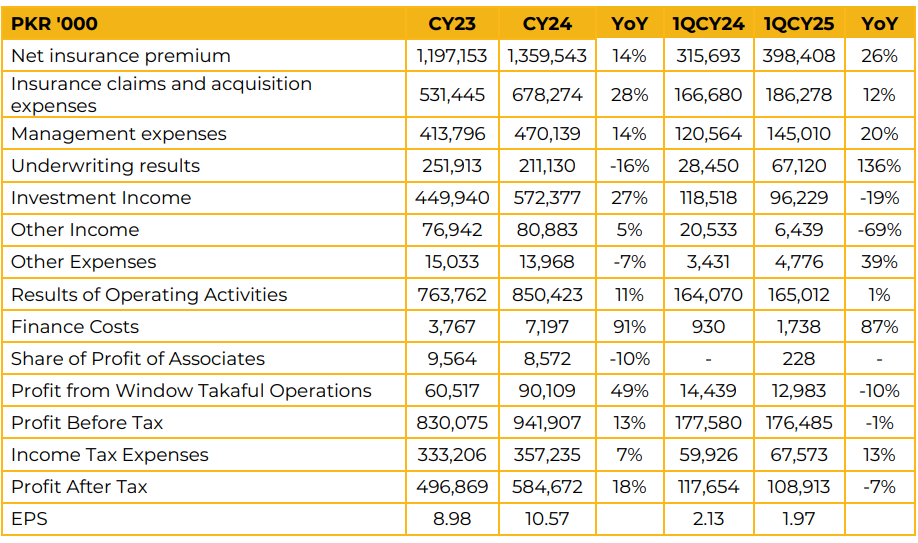

In CY24, CENI reported a net profit of PKR 584.67 million (EPS: PKR 10.57), up 18% from PKR 496.87 million (EPS: PKR 8.98) in CY23. Gross Written Premium rose 23% YoY to PKR 2.73 billion, outpacing industry growth of 18%. Net claims increased 23% YoY to PKR 760.64 million, with the net claims ratio rising to 60% from 54% in the SPLY. Income from insurance operations declined 10% YoY to PKR 238.77 million.

Investment income rose 24% YoY to PKR 703.14 million, supported by improved stock market performance and higher interest rates. Management expects a decline in investment income in CY25 due to falling interest rates but plans to increase the size of the investment portfolio to mitigate the impact.

The current investment mix comprises 35% equity and 65% fixed income, with a gradual shift towards equities planned as long-term PIBs mature. GWP composition was: Fire & Property 26%, Marine 22%, Motor 24%, Health 24%, and Miscellaneous 4%. Market share increased to 1.25%. A cash dividend of PKR 6 per share was paid in CY24, supported by higher investment and other income. Going forward, management plans to expand the branch network, focus on quality business, increase the Takaful portfolio, and maintain a balanced allocation between equity and fixed income to ensure consistent returns.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.