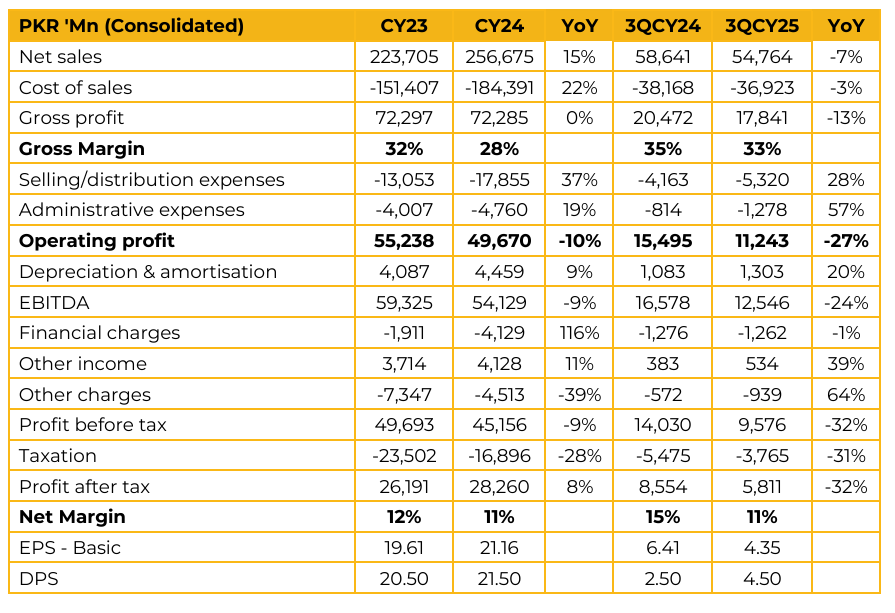

Engro Fertilizers Limited (EFERT) reported consolidated earnings per share of PKR 21.16 for CY24, compared to PKR 19.61 in CY23. Furthermore, in 3QCY25, the company reported earnings per share of PKR 4.35, compared to earnings per share of PKR 6.41 in the same period last year (SPLY).

Year to date urea sales stood at 1,280 KT, translating into an estimated 30% market share. As of 3QCY25, there total inventory levels were reported at 523 KT. In the DAP segment, the company recorded 97 KT of YTD sales, reflecting a 12% share of the total market.

During the period, the company extended discounts ranging between PKR 250–325 per bag, a trend that continues into the current quarter. Management commented that selling and distribution expenses were impacted by a reclassification adjustment during the year.

The company has also introduced TSP as a cost-effective alternative to DAP, offering comparable phosphate content but lower nitrogen levels, and priced at a discount of approximately PKR 2,000 per bag. Management expects stronger offtake in the coming quarters, supported by all three plants currently operating at full capacity. Meanwhile, discussions with the Ministry remain ongoing on broader policy matters, particularly gas allocation for the fertiliser sector.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.