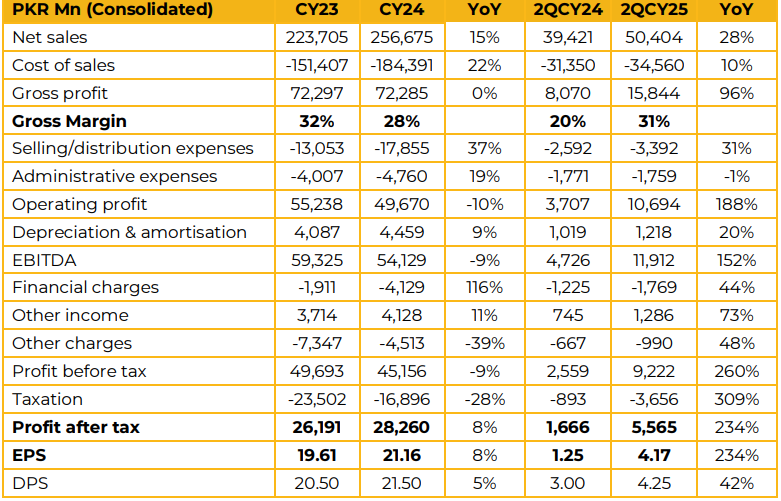

Engro Fertilizers Limited reported earnings per share of PKR 21.16 in CY24 against earnings per share of PKR 19.61 in CY23, an increase of 8%. Net revenue in CY24 reached PKR 256.7 Bn up 15% from PKR 223.7 Bn in CY23. The company saw its gross margin decrease from 32% in CY23 to 28% in CY24.

In this fiscal year the company has seen its gross margin improve to 31% in 2QCY25 compared to 20% in SPLY. Net revenue in 2QCY25 was PKR 50.4 Bn, up 28% from PKR 39.4 Bn in 2QCY24. Earnings per share for 2QCY25 clocked in at PKR 4.17, up 234% from PKR 1.25 in 2QCY24. EFERT saw a market share of 34% in 2QCY25 compared to 24% in 1QCY25 in urea sales. Management noted that the urea market remains under stress due to weak farm economics.

The company achieved a market share of 19% in 2QCY25 compared to 16% in 1QCY25 in the DAP segment. It was also revealed that international prices for DAP are up 23% year to date while local prices haven’t risen by as much hence margins have been under pressure in this segment. With regards to the pressure enhancement facility project the management apprised that phase 1 is near completion while phase 2 is also on track with orders for compressors being placed. With regards to the possibility of exports due to rising industry inventory levels, the management apprised that discussions are ongoing with the relevant authorities.

No clarity was given on the price of export if it is allowed. Moving forward, the management expects demand growth to remain subdued as changes in regulations on support prices have had an impact on farm economics.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.