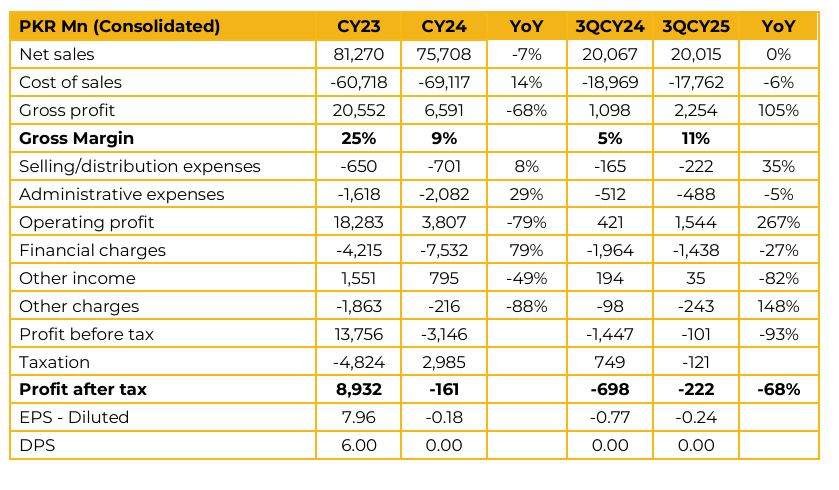

Engro Polymer & Chemicals Limited recorded diluted loss per share of PKR 0.18 in CY24, as compared to earnings per share of PKR 7.96 in CY23. The company recorded net sales of PKR 75.7 Bn, down 7% from PKR 81.3 Bn in CY23. Along with this, it saw its gross margin contract from 25% in CY23 to 9% in CY24. As a result, gross profit reduced 68% from PKR 20.6 Bn in CY23 to PKR 6.6 Bn in CY24. EPCL posted loss after tax of PKR 161 Mn in CY24, compared to profit after tax of PKR 8.9 Bn in CY23. In 3QCY25, the company saw its gross margin improve to 11% compared to 5% in SPLY. This was driven by cost efficiencies and an improvement in core delta.

The company apprised that while the selling price of PVC was not increasing the sustained oversupply of ethylene was causing the core delta to improve and therefore the management expressed cautious optimism regarding the future. With regards to power supply,

the management highlighted that while the off grid captive levy was notified at PKR 791 per MMBtu, it is notified with a lag and can vary and while it was imposed from March the actual levy did not reach 791 until 3QCY25. The management also revealed that it was evaluating all options for alternate power supply including third party gas suppliers, solar, coal and grid. It highlighted that its core business requires a high level of reliability from its power source of over 94%.

It expects to present a plan for power options by the end of CY25 or the start of CY26. It was also impressed upon the participants that the management aims to present a plan which would resolve the power/power cost issue for the next 10-15 years and allowed the company the flexibility to move between different power sources. The total energy requirement of the company is 55MW. Core delta stood at USD 334/ton in September and has seen more relief in the last 2 weeks. The management expects that further relief will be seen next year as more supply of ethylene comes online. On the other hand, they also expect new capacities to come online which could briefly weigh on margins.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.