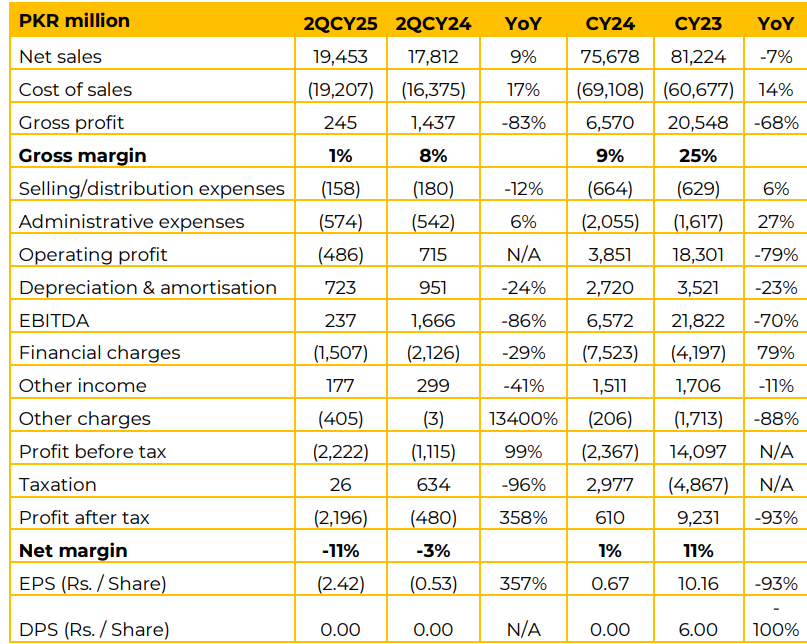

Net sales rose by 9% YoY in 2QCY25 to PKR 19,453 million, supported by higher volumetric PVC sales. Cost of sales increased by 17% YoY in 2QCY25 and by 14% in CY24, reflecting higher gas prices and levies. This outpaced the growth in revenue and severely compressed margins.

Net loss widened to PKR 2,196 million in 2QCY25 compared to a loss of PKR 480 million last year. Full-year net profit declined sharply to PKR 610 million, down 93% from PKR 9,231 million in CY23. This decline is attributed to lower core delta (the primary margin driver), higher gas prices, and the absence of a tax income taken in the previous year.

A provision of approximately 1.4 billion PKR has been made for the gas levy for March to June 2025, based on the previous rate of Rs. 791 per MMBTU, as clarity on the exact levy application is awaited. The PVC segment remains EPCL’s core business, contributing nearly 80% to the company’s revenue and contribution margin. The average core delta dropped to $275–280/ton in 1H2025, compared to $330–350/ton last year. Although it had touched a low of $240/ton earlier in the year, it has since recovered and is currently trending at $320/ton.

PVC prices are now around $730/ton and are expected to remain range-bound ($700–800/ton) in 2025, with potential for recovery to historical levels in late 2025 or early 2026. Domestic demand remains robust with a 24% YoY increase in sales volumes in H1, supported by improved construction activity, monetary easing, and a stable macro environment.

Over-supply in the PVC market, driven by weak construction activity in the US and China, along with new capacities, impacts global pricing. Prices are influenced by global supply and demand dynamics, and no single entity can price significantly higher than global rates. Domestic PVC demand has remained solid, with volumes increasing in H1 2024. EPCL’s Q2 2025 volumetric sales were the best ever. Improvement in the construction segment, driven by reduced policy rates (interest rates halved from 22% to 11%), revived real estate sector, and stabilized inflation and exchange rates, leading to demand for pipes, fittings, cables, and construction materials.

In the Chlor-Alkali business, which accounts for 20% of contribution margin, caustic soda prices and volumes remained largely stable. Margins remained under pressure due to energy costs, as power makes up 80% of cost in this segment. Management expects some relief in margins following the recent reduction in gas levy from Rs. 791 to Rs. 238 per MMBTU in July 2025. Domestic market is stable, with some new capacities expected in China and Southeast Asia, which should help absorb surplus in dollar prices. Hydrogen Peroxide (HPO) and HTDC projects were successfully commissioned earlier in the year, with operations stabilizing. EPCL has gained approximately 15% market share since commissioning. Management expects the HPO segment to contribute 2–5% to total margins at full capacity.

Despite lower prices compared to 2023, margins are expected to improve as demand builds. The company continues to face challenges related to gas pricing and availability. Captive gas prices and levies have significantly raised production costs, prompting management to actively explore alternatives including grid connectivity, renewables, coal, and gas engines. However, any power transition will require careful planning given the reliability needs of the VCM plant. Energy efficiency projects are also underway to mitigate long-term cost pressures.

Going forward, EPCL expects PVC prices to remain rangebound between $700–800/ton in 2025 amid global oversupply, with recovery to $900+ possible by late 2025 or early 2026; domestic demand remains strong, supported by monetary easing and revived construction activity.

Caustic margins are likely to improve following the gas levy reduction. The company is actively evaluating alternate energy options. Hydrogen Peroxide operations have stabilized post-commissioning, with 15% market share achieved and contribution expected to gradually build. Focus remains on cost discipline, domestic market growth, and strategic energy transition to ensure longterm competitiveness.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose