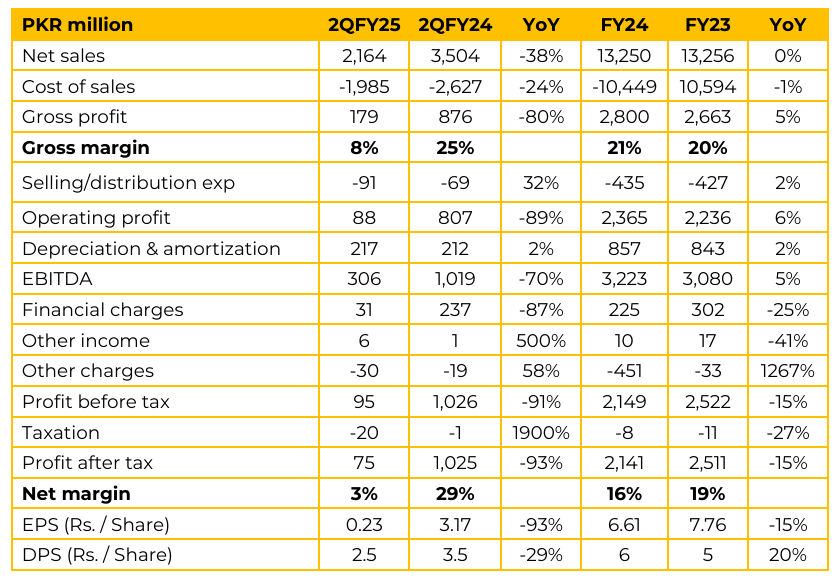

Net sales declined by -38% YoY in 2QFY25 to PKR 2,164 million. Cost of sales decreased by 24% YoY in 2QFY25 Net profit decreases to PKR 75 million in 2QFY25 compared to a profit of PKR 1,025 million SPLY. Full-year net profit declined to PKR 2,141 million, down 15% from PKR 2,511 million in FY23. EPQL’s recent financial performance has been significantly impacted by both operational adjustments and market shifts, leading to a decline in key profitability metrics despite improvements in certain areas like liquidity and receivables.

EPQL signed an amendment agreement in February 2025, moving to a hybrid take-and-pay regime where capacity payments are directly linked to the load factor. This operational change, combined with a scheduled 20-day outage in May 2025, led to a decrease in net electrical output from 437 GWh to 363 GWh and a drop in load factor from 46% to 39% for the first half of 2025. Despite the significant decline in profitability, EPQL maintained a “very good dividend per share ratio”, paying a PKR 10 per share dividend, which was reportedly the highest in its history.

This was made possible by a substantial bullet payment received in March 2025, which placed the company in a comfortable liquidity position, allowing them to share the liquid cash with shareholders. In terms of operational economics, the company is in discussions with NEPRA and CPPA-G regarding the O&M indexation mechanism, where the reference amount is fixed for one year and adjusted in the subsequent year. EPQL anticipates an improvement in its load factor to around 48-50% if it receives approval for PEL gas, compared to the current 39% for the first half of 2025. EPQL has shifted to a hybrid take-or-pay arrangement where capacity payments are linked to load factor performance.

Under this model, a minimum floor of 35% is applied to the ROE (Return on Equity) and DC (Debt Component) elements of the Capacity Payment Price (CPP), ensuring partial protection against lower dispatches. If load factors fall below this threshold, these components remain payable at the 35% level; however, no fixed O&M payment is made at zero load factor.

Conversely, at 100% load, payments revert to pre-amendment levels. Pakistan’s macroeconomic situation has shown improvement, leading to a slight increase in power demand of approximately 4% in the first half of 2025. EPQL’s merit order position has improved from #11 to #9 because two other plants are no longer appearing in the merit order. Despite the plant’s age and rapid technological changes, EPQL believes that no impairment is currently necessary, an assessment based on multiple valuations and auditor satisfaction.

Additionally, EPQL is mandated to share O&M and fuel savings with the government as per the Memorandum of Understanding (MOU), although the precise timing for this to be reflected in financials is still being determined.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.