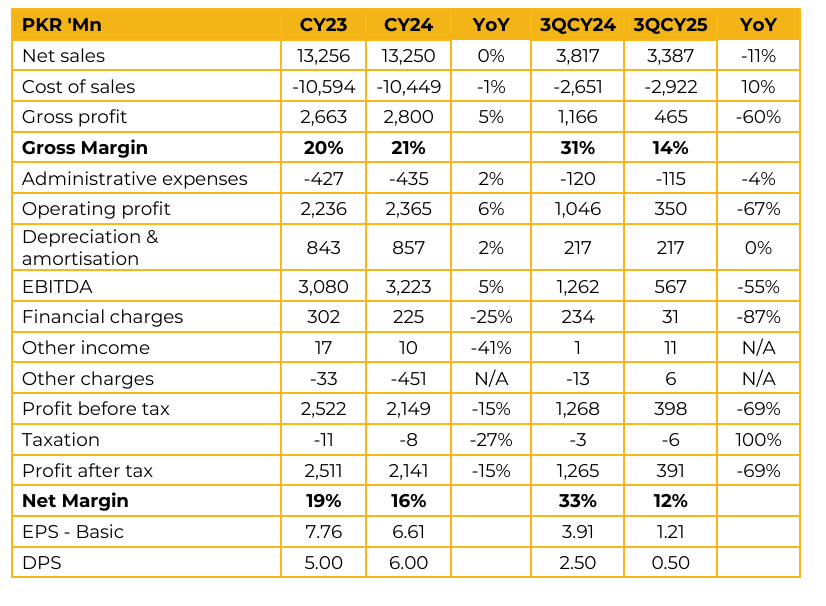

Engro Powergen Qadirpur Limited (EPQL) reported earnings per share of PKR 6.61 for CY24, compared to PKR 7.76 in CY23. Furthermore, in 3QCY25, the company reported earnings per share of PKR 1.21, compared to earnings per share of PKR 3.91 in the same period last year (SPLY).

The country’s overall power demand is expected to remain subdued due to the ongoing shift toward solar energy. However, government initiatives such as the enforcement of the captive power levy and the introduction of incentive packages could provide an uplift to industrial and agricultural demand.

On the alternate fuel front, the Company continues to engage with the PPIB and is awaiting the issuance of an NOC for the utilization of PEL(Pakistan Exploration Limited) gas which is expected to be received within few weeks. In the meantime, testing of PEL gas has commenced.

The PEL gas is priced at around USD 5.5 per MMBtu and currently ranks 14th on the national merit order. In addition, the Company remains proactive in exploring other local fuel alternatives. The existing permeate gas supply presently stands at 11th position in the merit order. The Company’s revenue in Q2 declined primarily due to a scheduled outage lasting approximately 20 days.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.