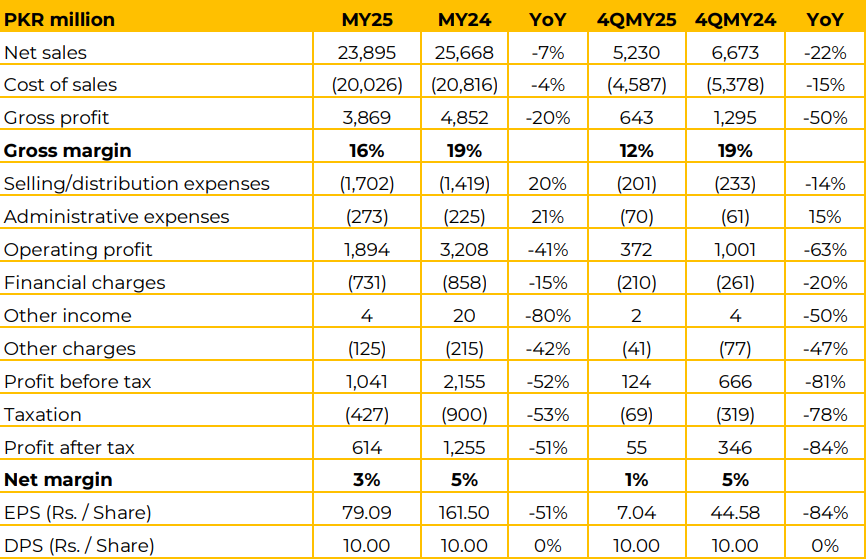

Exide Pakistan Limited reported net sales of PKR 23,895 million in MY25, down 7% YoY, while 4QMY25 sales stood at PKR 5,230 million, showing a 22% YoY decline. The revenue decrease was attributed to intense price competition, which necessitated a reduction in prices to match competitors Gross margin for the year stood at 16% versus 19% last year.

For 4QMY25, gross profit fell 50% YoY to PKR 643 million, with margin compressing to 12%. Profit after tax for MY25 stood at PKR 614 million, representing a 51% YoY decline. Net margin dropped to 3% from 5% last year. Earnings per share declined to PKR 79.09 in MY25 from PKR 161.50 last year, while the company maintained a dividend payout of PKR 10.00 per share.

The company faces stiff competition, particularly from new unlisted companies that are generally less tax-compliant than public listed companies. Lead constitutes about 65% of the battery cost and is primarily sourced locally. However, if local suppliers significantly increase prices, the company imports lead to optimize the cost. Minor components include plastic granules (for battery blocks), separators (for insulation), and antimony (which is currently scarce in the market). Sales to the automotive sector do not exceed 5% of total sales, as the volume of automotive vehicle assembly in Pakistan is not significant enough. The company’s products are versatile (e.g., auto batteries can be used in UPS).

The application depends on the buyer’s choice. However, the company advises against using automotive batteries for UPS or solar applications due to different cycling requirements, as doing so often leads to customer claims and problems. Chase Research [email protected] +92-21-35293054-60 Symbol: EXIDE Current Price: PKR 870.00 Market Cap (PKR bn): 6.75 Total Shares (mn): 7.77 Free Float (mn): 1.94 52 Week High: PKR 1,090.00 52 Week Low: PKR 630.10 Briefing Notes July 29, 2025 +92 213 529 3054-60 www.chasesecurities.com [email protected] Page 2 of 3 Future performance is uncertain and may be impacted due to challenges including decline in purchasing power, increased competition and increasing prices of raw materials, energy & labor.

Going forward, contingent upon commercial viability, the company plans to move towards producing lithium-ion batteries (for EVs also). Currently, they are importing lithiumion batteries from China to establish a market presence, with plans for local production once the market size justifies it. An increase in EV numbers is anticipated by 2026. However, the management noted that the high price of new EV models (e.g., PKR 2 crore for BYD Shark) might initially limit their sales volume.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.