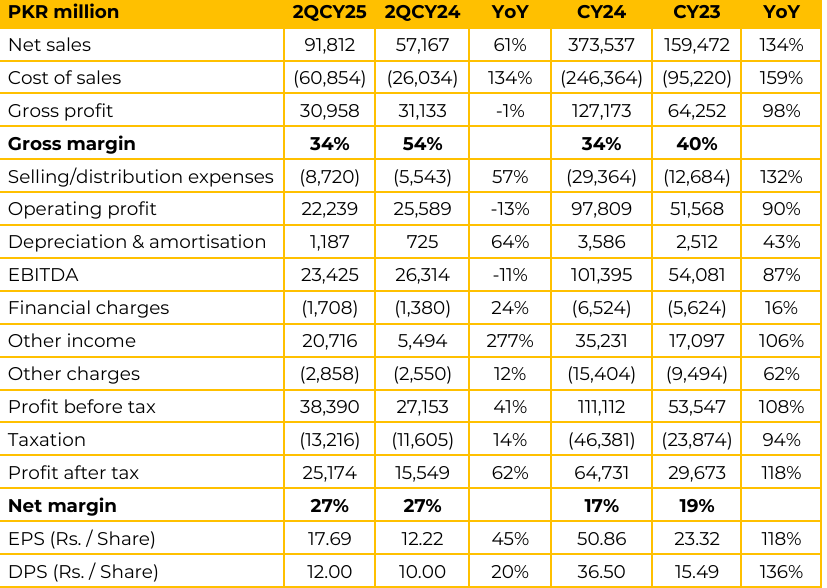

FFC’s net sales rose sharply by 61% YoY in 2QCY25 to PKR 91.8 billion, compared to PKR 57.2 billion in the same period last year. Despite topline growth, gross profit remained flat in 2QCY25 at PKR 30.96 billion, slightly down from PKR 31.13 billion in 2QCY24. As a result, gross margin compressed to 34% in 2QCY25 versus 54% in the same period last year. Selling and distribution expenses climbed 57% YoY to PKR 8.7 billion in 2QCY25, attributed to broader distribution operations including FFBL volumes. Operating profit fell 13% YoY to PKR 22.2 billion in the quarter.

Earnings per share improved 45% YoY to PKR 17.69 in the quarter and surged 118% to PKR 50.86 for CY24. The company also increased its dividend payout to PKR 12.00/share in 2QCY25 (up 20% YoY) and PKR 36.50/share for CY24, marking a significant 136% YoY growth. Management highlighted a 100bps reduction in policy rate since January 2025 to 11%, with inflation trending downward. Despite this, agricultural growth contracted to 0.56%, primarily due to adverse climate conditions and lower crop production. Farmer income losses have been estimated at PKR 1 trillion.

The management emphasized the need for timely government intervention to revive the sector. A review of net farm economics showed significant declines in incomes across all key crops, driven by high input costs and unfavorable weather. FFC maintained stable operations amid sectoral stress, aided by strong equity investment income and crossed the USD 2 billion market capitalization milestone. Inventory levels were lower due to active production management. Industry-wide fertilizer inventory stood at 1.6 million tons, weighing on sector dynamics. Urea and DAP market shares fell, exacerbated by weak farm economics.

Despite rising global Urea prices, fueled by export restrictions from China and supply disruptions in the Middle East, FFC provided Urea domestically at nearly half the import price, delivering PKR 81 billion in benefit to farmers. However, the Urea market contracted 23%, with FFC’s own offtake down 25%. Nevertheless, the company held just 26% of total industry inventory while contributing 43% to total production. DAP volumes also declined, with FFC’s production at 57% and inventory at 40% of the industry total. Its DAP market share declined to 64% from 71%.

Consolidated net revenue stood at PKR 155 billion for 1HCY25, including sales from fertilizer, Sona DAP, and Sona Granular Urea. Gross profit showed resilience, though margin compression occurred due to higher input costs. Other income clocked in at PKR 28 billion primarily driven by investment income. Dividend income breakup included PKR 9 billion from energy investments, PKR 7 billion from PMP (Moroccan venture), and PKR 3 billion from banking investments. FFC has launched 100 Sona Centers, covering approximately 1.3 million acres and providing access to bank partnerships for cheaper financing. These centers are expected to support farm productivity and improve market access for farmers. FFC is fully committed to becoming Sharia compliant within this calendar year.

Majority of investments have been shifted from conventional to Sharia compliant funds. The primary challenge is the percentage of non-compliant income relative to the 5% benchmark. FFC owns 65% of AKBL, but it’s treated as an associate, not consolidated, so it does not increase FFC’s non-compliant income for reporting purposes. AKBL is also targeting 30% Sharia compliant branches this year, aiming for full compliance by 2027. .

Going forward, the management anticipates Industry’s Urea Inventory level to remain in line with the current levels of ~ 1.3 million tons. No such discussions are ongoing regarding the allowance of Urea exports at the moment. Management is upbeat about sales due to FFC’s wide distribution network and expects higher production with lesser industry inventory.

FFC is monitoring rising international prices and remains focused on cost management and market responsiveness. The company is actively working on managing costs and tracking international prices to make necessary interventions. FFC expects an increased Urea offtake due to the Punjab government’s announcement of the Kisan card program for the Rabi season. The management noted that there is no longer any discussion on gas price uniformity in the industry.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.