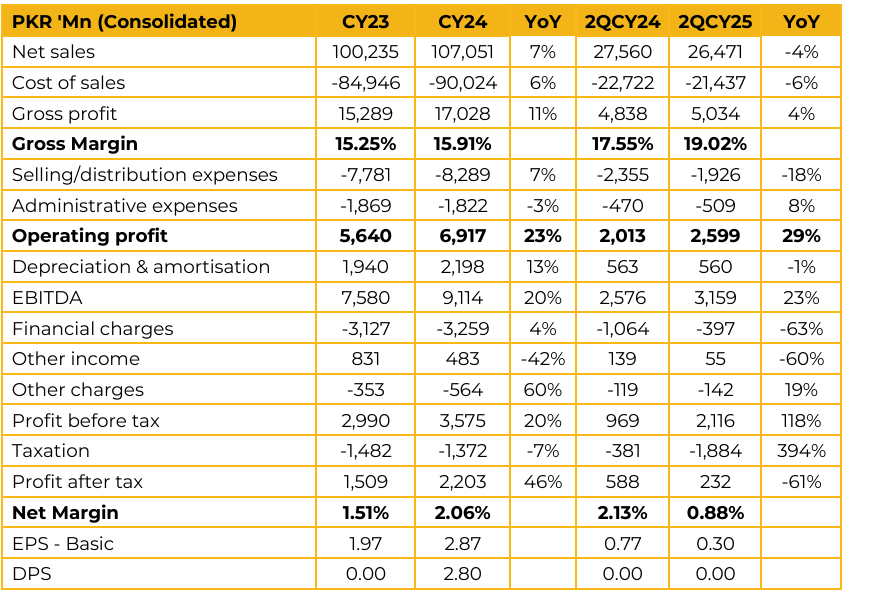

Frieslandcampina Engro Pakistan ltd (FCEPL) reported consolidated earnings per share of PKR 2.87 for CY24, compared to PKR 1.97 in CY23. Furthermore, in 2QCY25, the company reported EPS of PKR 0.30, compared to PKR 0.77 in the same period last year (SPLY).

Although milk prices have been stable for the last six months, they are expected to be impacted by recent floods. At the same time, the company maintained its position as the market leader in the UHT milk segment The company stated that their sourcing strategy gives them a significant advantage in terms of both availability and pricing. In the first half of fiscal year 2025 (1HCY25), the company recorded a high effective tax rate of 67%.

This was a one-time event resulting from a Supreme Court ruling in May 2025 regarding previous tax obligations. Management has confirmed that this will not affect future quarters. The company is navigating a complex landscape to secure a larger market share in the value-added segment. Management commented that they have achieved rapid growth and are enjoying higher profit margins in this segment. To capitalize on this success, they are also planning to launch several new products.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.