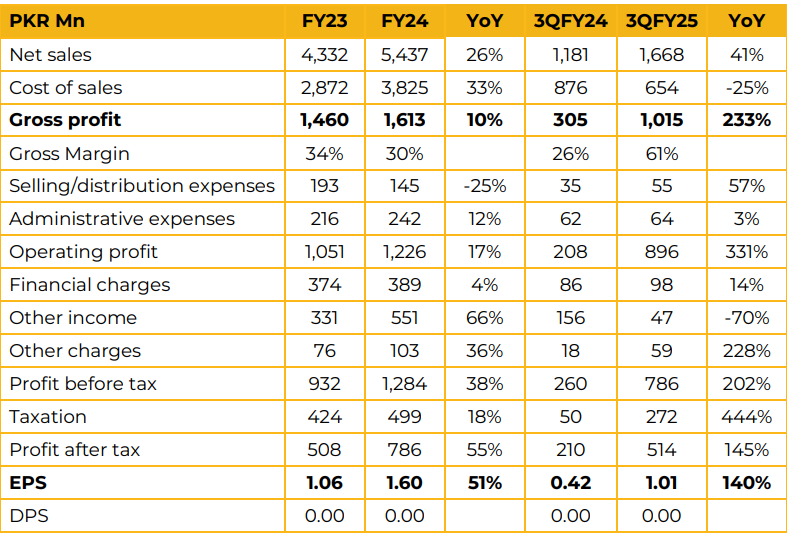

Ghani Chemical Industries Limited reported earnings per share of PKR 1.60 in FY24, up 51% from PKR 1.06 in FY23. This translates into profit after tax of PKR 786 Mn compared to PKR 508 Mn in SPLY, an increase of 51%. Total revenue in FY24 reached PKR 5.44 Bn against PKR 4.33 Bn in FY23, an increase of 26%.

The company reported earnings per share of PKR 1.01 in 3QFY25, up 140% compared to 3QFY24. This was also a growth of 23% when compared to PKR 0.82 in 2QFY25. The management apprised that its 275 TPD plant located in Hattar Special Economic Zone was commissioned in April 2025. It expects this to significantly contribute to the profitability of the company due to its efficiency and lower fuel costs along with the 10 year income tax holiday this plant has received. Additionally, the management is looking into adding solar at all of its sites in order to control its energy costs.

The company is currently working to finalize a long term agreement with a leading steel mill in KPK to supply 100,000 cubic meters per month of liquid oxygen. It was also revealed that the company has secured power at 5.2 cents per KWh in Oman where it plans to dismantle and shift its 110 TPD plant from Lahore to cater to the middle east market. It has secured this power for 25 years and is optimistic that the low rate will allow the company to operate competitively. Moving forward, the management was optimistic about continued growth in profitability.

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.