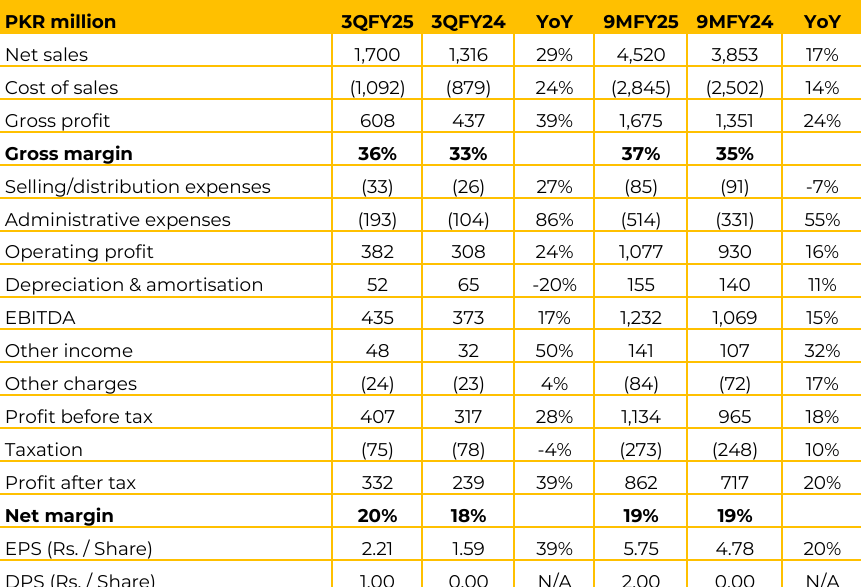

Ghani Value Glass reported net sales of PKR 1,700 million in 3QFY25, up 29% year-on-year, while cumulative 9MFY25 sales stood at PKR 4,520 million, reflecting a 17% increase compared to the same period last year. Cost of sales rose by 24% year-on-year to PKR 1,092 million in 3QFY25.

As a result, gross profit improved by 39% to PKR 608 million, with gross margin rising to 36% from 33% in the same quarter last year. For 9MFY25, gross profit stood at PKR 1,675 million, up 24% year-on-year. Earnings per share rose to PKR 2.21 in 3QFY25 from PKR 1.59 in 3QFY24. The company declared a dividend of PKR 1.00 per share during the quarter, bringing the cumulative payout to PKR 2.00 per share in 9MFY25. GVGL mainly relies on WAPDA for power, as it is cheaper than captive power. Hence, there is no impact of gas price increases on Ghani Value Glass.

The company has developed many local vendors for other raw materials but still imports some, such as colors and silver. Ghani Value Glass was the first in Pakistan to introduce proper mirror manufacturing, and pioneered aluminum glass (a cost-effective alternative to silver mirror with similar quality).

In appliances division, a digital printer was installed 2-3 years ago, which helped gain market share in the appliances segment. Screen printing capabilities were installed two months ago, expected to gain the market next year by producing front doors for appliances like refrigerators. Going forward, the new project regarding printing glass for appliances has become operational, expected to have a positive impact in boosting revenue and overall profitability of the company.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.