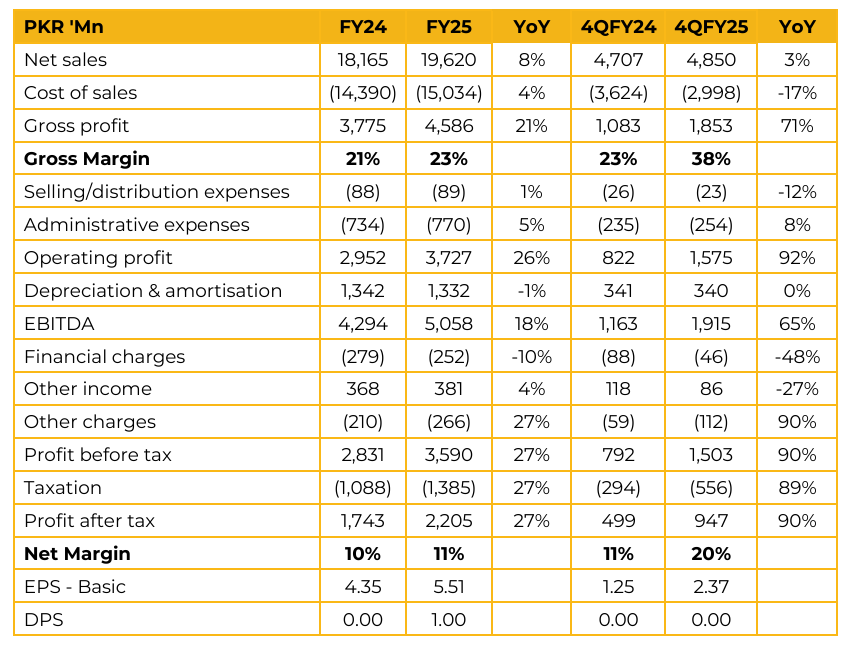

Gharibwal Cement Limited (GWLC) reported earnings per share of PKR 5.51 for FY25 (FY24: 4.35). Furthermore, in 4QFY25, the company reported earnings per share of PKR 2.37 (4QFY24: 1.25). Dispatches for FY25 totaled 1.2 million tons. The average retention price during FY25 was stated as being around PKR 16,000 per ton. The current retention price (as of October 2025) is approximately PKR 15,000 per ton.

The current royalty rate remains the same at 6% of the market price. The company is currently under litigation with the Government of Punjab regarding this rate, along with the other industries in the North. The operation efficiency was targeted through the successful completion of a cooler retrofit project and other optimization steps. Due to operating the plant at almost full capacity during the last quarter of FY 2025 to perform modifications (including repair of the CF silo), the company ended the year with a very huge stock of clinker, around 300,000 tons. This maximization of operations drastically reduced cost factors in that quarter.

In the subsequent quarter (July to September), the company did not operate the plant much due to having enough clinker stock to meet dispatch requirements.

The power mix for FY25:

• WR (Waste Heat Recovery) and CFB Boilers: 55%

• Furnace Oil: 22%

• Grid: 11% • Solar: 17%

The average cost of various power sources:

• Average power cost (FY25): ~Rs. 20/unit (only fuel)

• Average WHR & CFB total cost (FY2025): ~Rs. 16/unit (only CFB cost ~Rs. 28/unit)

• Average Grid cost (FY25): ~Rs. 50/unit

• Average Grid current cost (Jul25-Sep25): ~ Rs. 38/unit

• Expected solar generation 30 million unit (approx.) per year

GWLC added 12.5 MW of solar capacity (in the final month, June, of the last quarter ending June 30, 2025). Total solar capacity is now 24.5 MW. The solar units will primarily replace power currently bought from the grid (WAPDA).

Management projects the future power mix to shift to 50% from WR/CFB, 25% from Solar, and 25% from the Grid. The 2025 coal mix, based on Net Calorific Value (NCB), was 38% Local Coal and 62% Imported Coal. Imported coal includes Afghan and South African coal. The average coal cost in 2025 closed at PKR 34,000 to PKR 35,000 per ton.

GWLC is currently not importing any Afghan coal due to recent conflict/logistics issues. The last procurement of Afghan coal was around PKR 42,000 per ton. For South African coal, the import cost is less than $100 per ton plus freight and clearing charges, making it appear cheaper than Afghan coal.

Work on Line 2 is proceeding according to plan. The speed of the project’s completion is dependent on market recovery, demand, and significant improvement in dispatch figures.

The capacity of the new Line 2 is planned to be around 10,000 tons. The final cost of setting up Line 2 has not been concluded, but it is expected to be significantly less than the cost of a new industry plant because various project components are already completed, equipment has been imported, and civil work is underway Going forward, management expects decent growth in dispatches for FY 2026, forecasting figures anywhere between 6% to 10%. Margins are expected to remain the same as the last year.

The overall margin is expected to hold because cost factors (like electricity and coal) are also expected to reduce. If prices sustain and the company achieves expected growth in quantity, margins can be maintained.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.