How to Invest in Pakistan

How to Invest in Pakistan is a question many people are asking today:

“I want to start investing, but I don’t even know how accounts work or where to begin.”

This reflects a wider reality, interest in the Pakistan Stock Exchange (PSX) has grown sharply, yet knowledge gaps about investing in Pakistan remain. In 2025, with PSX ranking among the top-performing stock markets globally, the opportunity to learn and act has never been stronger.

Market Reality: Numbers That Matter in PSX 2025

Let’s start with the hard data.

FY25 returns: The KSE-100 index rose ~60% in rupee terms and 57% in dollar terms, putting PSX among the top global performers.

Two-year streak: Combining FY24 and FY25, cumulative returns hit ~203% in PKR and 206% in USD.

Liquidity: Average daily traded value was ~PKR 28 billion; average daily volume ~631 million shares in FY25.

Investor base: While registered accounts number in the millions, only a fraction are actively trading each week.

These figures show both the strength of the PSX and the untapped potential for investors in Pakistan.

Why 2025 Is the Best Time to Start Investing in Pakistan

Several shifts explain why PSX surged, and why this moment matters.

Monetary easing: The policy rate fell sharply from ~20.5% to near 11%, making equities more attractive.

Macro stability: A successful IMF program and improved foreign exchange inflows boosted investor confidence.

Global recognition: Fitch revised Pakistan’s credit outlook upward during FY25.

Relative performance: In FY25, PSX delivered 55%+ returns, outperforming gold (~47.56%), T-Bills (~12.68%), and other assets.

Together, these factors suggest the rally is more than speculation, it reflects structural change.

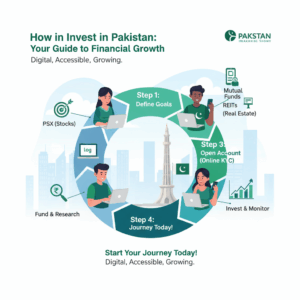

How to Invest in Pakistan: Step-by-Step with Chase Securities

Investing in Pakistan through the PSX has never been this simple. With Chase Securities, you can open your trading account online in just a few easy steps. Our team walks you through everything, from completing your KYC to setting up your CDC account, so you can start investing without any stress.

You don’t need a huge amount to begin. Even with PKR 10,000 to 25,000, you can start buying shares in strong, established companies and learn how the market works at your own pace. Our experts help you pick reliable blue-chip stocks and diversify your investments, so your portfolio stays balanced and protected.

The key is patience. Stay consistent, reinvest your profits, and avoid emotional decisions when the market moves. With the right mindset, and Chase Securities by your side, you can steadily grow your wealth and build a confident future as an investor in Pakistan.

1. Open Your Account with Us

At Chase Securities, opening a trading account is straightforward. Our team helps you complete KYC, obtain your Unique Identification Number (UIN), and set up your Central Depository Company (CDC) sub-account quickly so you can start trading with confidence.

2. Start Small but Smart

You don’t need a huge sum to begin. With Chase Securities, many clients start with PKR 10,000 – 25,000. What matters most is building consistency, and we’ll guide you on how to put every rupee to work efficiently.

3. Focus on Blue Chips First

Our research desk emphasizes large, liquid companies that provide stability. For new investors, we recommend allocating most of your funds into reliable blue-chip stocks, while keeping a smaller portion for learning opportunities.

4. Diversify Early with Expert Guidance

Chase Securities helps you spread risk across multiple sectors, such as banks, cement, technology, and energy, so your portfolio isn’t tied to the fortunes of a single company or industry.

5. Think Long Term

Avoid chasing daily “hot tips.” Our advisory services highlight long-term strategies that have historically rewarded patient investors, like those who held through the FY24–25 reforms and saw compounding returns.

Example: What PKR 100,000 Became in PSX FY25

If you had invested PKR 100,000 in the KSE-100 index at the start of FY25, here’s what happened:

- Starting: PKR 100,000

- Gain (59%): PKR 59,000

- Final: PKR 159,000 (before costs/taxes)

This example shows the power of long-term investing in Pakistan’s stock market.

With Chase Securities beside you, learning how to invest in Pakistan becomes a rewarding experience, not a guessing game.

What New Investors in Pakistan Often Worry About

From conversations across local investor forums, five recurring concerns emerge:

- Fear of manipulation: Many worry about pump-and-dump moves.

- Research gap: People feel unsure which data or reports to trust.

- Currency risk: Returns in PKR may not match USD stability.

- Faith-based investing: Some seek Shariah-compliant options only.

- Small capital anxiety: Beginners hesitate, thinking they need huge amounts to start.

A popular piece of advice circulating in 2025 was:

“Put 70% in stable companies you trust, and use 30% to learn the market.”

This approach balances learning and discipline. Market data shows PSX 2025 outperformed not just in PKR but also in USD, reflecting growing trust and better governance.

FAQs about how to Invest in Pakistan

Q1: How much do I need to start investing in Pakistan?

You can begin with as little as PKR 10,000–25,000 through most brokers.

Q2: Is currency depreciation a real risk?

Yes, but FY25 data shows strong dollar-based returns too (~57%).

Q3: Are there Shariah-compliant options?

Yes, the KMI-30 index and many listed firms are certified halal investments.

Conclusion

The Pakistan Stock Market 2025 is not just rallying, it’s building long-term investor trust. With record turnover, economic reforms, and global recognition, PSX is becoming one of the most attractive emerging markets for investors.

If you’ve been wondering how to invest in Pakistan, now is the time to act.

Open your account with Chase Securities today and take your first step toward smart investing in Pakistan.