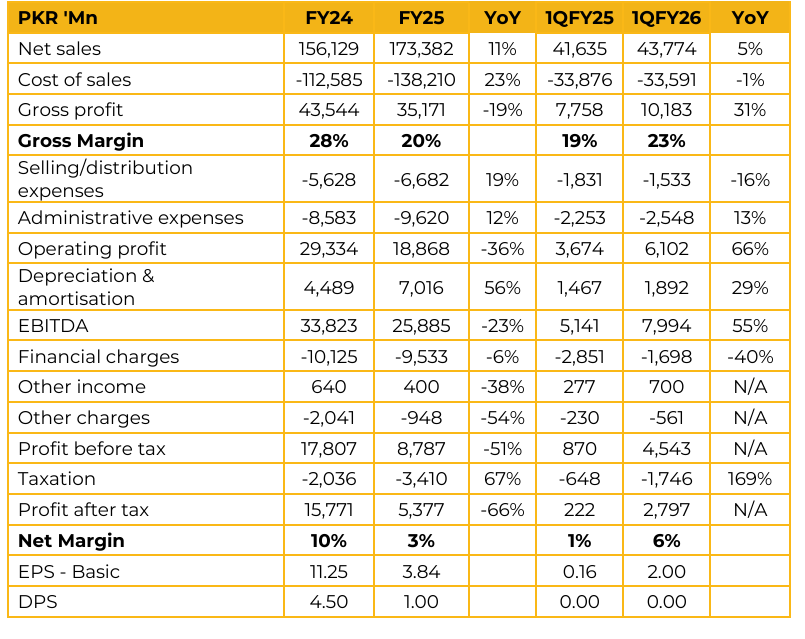

Interloop Limited (ILP) reported earnings per share of PKR 3.84 for FY25, compared to PKR 11.25 in FY24. Furthermore, in 1QFY26, the company reported earnings per share of PKR 2.00, compared to earnings per share of PKR 0.16 in the same period last year (SPLY).

The company’s total power requirement stands at 37–40 MW, with 83% sourced from WAPDA, 9% from gas, and 7% from solar, resulting in a weighted average cost of PKR 33 per unit. During the previous year, 66% of steam was generated from biomass, 13% from gas, and 21% from waste heat recovery.

Operationally, the company was profitable only in the hosiery segment during FY25, while the denim and apparel segments remained loss-making. Going forward, management expects the hosiery business to maintain its current profitability levels, while efforts continue to reduce losses in the other two divisions.

For FY26, they expect the denim segment to turn slightly profitable, and the apparel segment to reach breakeven by FY27. The company has successfully completed its sixth hosiery plant. By 4QFY26, management plans to expand the denim segment by adding 7 new lines and increase capacity in the yarn dyeing division by 20 MT. On the global front, management highlighted that the cost base of American exporters has risen by around 20%, and their customers have been unable to fully pass on the increase to end consumers.

Although they have marginally raised product prices, this has led to demand compression. The company is at an early stage of entering the GCC market and is not pursuing any new product segments at present, focusing instead on stabilizing operations in the denim and apparel divisions. The current installed solar power capacity stands at 17.3 MW, with plans to expand to 25 MW by FY26. Management expects a payback period of approximately 2.5 years on this investment. They also Highlighted that if a 15% tariff is imposed on India, the impact on the company will be minimal, as it faces limited competition in its core export markets. Regarding the Egypt facility, management plans to bring the plant online in 1QCY27.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.