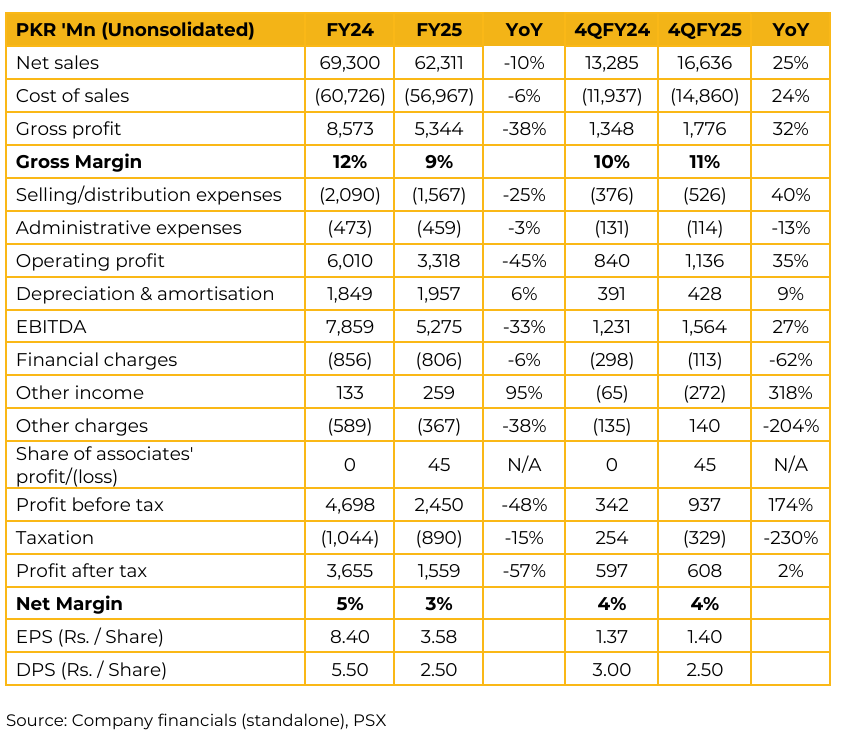

In FY25, ISL reported a net turnover of PKR 62 billion as compared to PKR 69 billion in SPLY. The gross margin fell to 9% from 12% during the same period. The company posted profit after tax of PKR 1.5 billion (EPS: 3.58) in FY25 as compared to PKR 3.6 billion (EPS: 8.40) in the SPLY.

ISL’s performance was impacted by circumvention of duties on imports from China and misuse of the FATA/PATA regimes, which allowed tax-exempt imports to be sold in the domestic market. Imports accounted for approximately 61% of the total market for cold-rolled, galvanized, and color-coated steel. ISL adopted a lean inventory strategy, buying only what was needed and turning inventory faster to manage price volatility and working capital. The company actively lobbied with regulators.

This has led to better administrative controls on FATA/PATA imports and the successful filing of an anti-circumvention petition, resulting in duties on galvalume, upon which stay has been sought by the importers and the matter is sub-judice. Importers have previously used the legal system to get stays on anti-dumping duties.

However, a recent ruling directs courts to collect a financial instrument (bank guarantee/pay order) if a stay is granted, which is expected to improve duty collection and enforcement. The tariff differential between raw material (Hot Rolled Coil – HRC) and finished products is now 7.5%. The effective duty on HRC is 2.5%, while the duty on finished goods imported from China under the FTA is 10% (5% Customs Duty + 5% RD) A 6.4 MW solar project has been installed, expected to contribute 10% of the energy mix in the coming year, reducing reliance on the grid and expensive captive power. ISL is aggressively pursuing export opportunities, with the US and EU markets opening up favorably.

The company is a preferred supplier in the US HVAC ducting segment due to superior product quality compared to Chinese and Vietnamese suppliers. ISL has successfully developed products previously not made in Pakistan, such as tin plate, non-grain-oriented electrical steel, weather-resistant steel, and high-tensile steel for auto manufacturing.

In the domestic market, galvanized steel constitutes about 60% of demand in ISL’s product category, with cold-rolled steel at 40%. Going forward, the management is optimistic about the company’s future, planning to enhance profitability by increasing capacity utilization to absorb fixed costs over a larger sales volume. The company is aggressively positioning itself to grow domestic market share, anticipating that recent regulatory actions against circumvention and misuse of FATA/PATA regimes will create a more level playing field and allow local manufacturers to capture a portion of the market share currently held by imports.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.