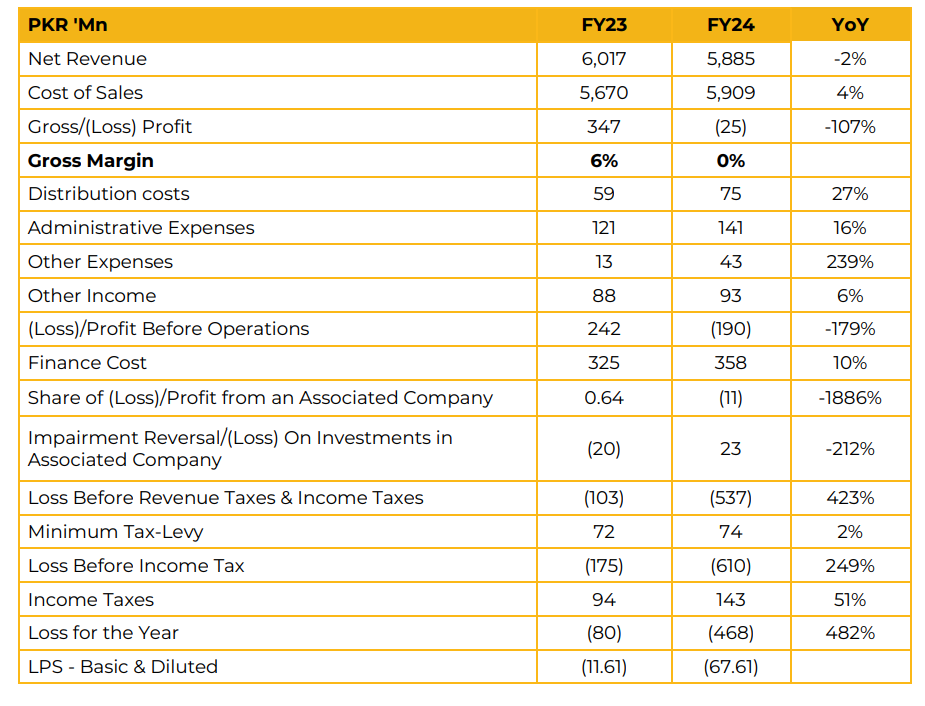

JDMT reported a net loss of PKR 467.58 million (LPS: PKR 67.61) in FY24, compared to a net loss of PKR 80.28 million (LPS: PKR 11.61) in CY23. In addition to pressure from imported yarn, a substantial increase in energy costs further weighed on profitability.

The Company reported a decline in net turnover by PKR 131.815 million compared to the previous year, primarily due to increased availability of imported, lower-cost yarn from China and Vietnam. This influx of cheaper alternatives in the market significantly impacted the Company’s pricing power and sales volume. During the year, the Company incurred a gross loss of PKR 24.571 million. The gross loss was due to imported cheaper yarn, higher wages and salaries, and higher cost of sales caused by increased fuel costs.

The loss before taxation stood at PKR 536.751 million. Power and fuel expenses surged to PKR 1,155.904 million, compared to PKR 720.586 million in the previous year, marking a sharp escalation in the cost structure. The adverse impact was compounded by multiple gas price hikes implemented by the Government during the reporting period. In November 2023, gas prices rose by 118%, from PKR 1,100 to PKR 2,400 per MMBtu, followed by an additional 15% increase to PKR 2,750 per MMBtu in February 2024.

This cumulative 150% rise in gas tariffs exerted significant strain on the Company’s operating margins. The Board of Directors has decided to temporarily suspend production due to adverse economic conditions, including high power costs, limited availability of affordable yarn, declining sales, and rising inventory levels amid a market slowdown. Management stated that continued operations have become financially unviable. Going forward, management will monitor conditions and resume production once feasible.

In the meantime, it is developing mitigation strategies, including exploring alternative energy sources, cutting non-essential costs, and shifting to high-demand yarn varieties in different geographies. Energy-efficient lean production is also underway.

Management has prepared a feasibility report for renewable energy sources; a 1MW energy mix will be included, and the company is awaiting working capital for this. Management urged the government to rationalize tax rates, impose tariffs on imported yarn, and apply antidumping duties to facilitate local producers.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.