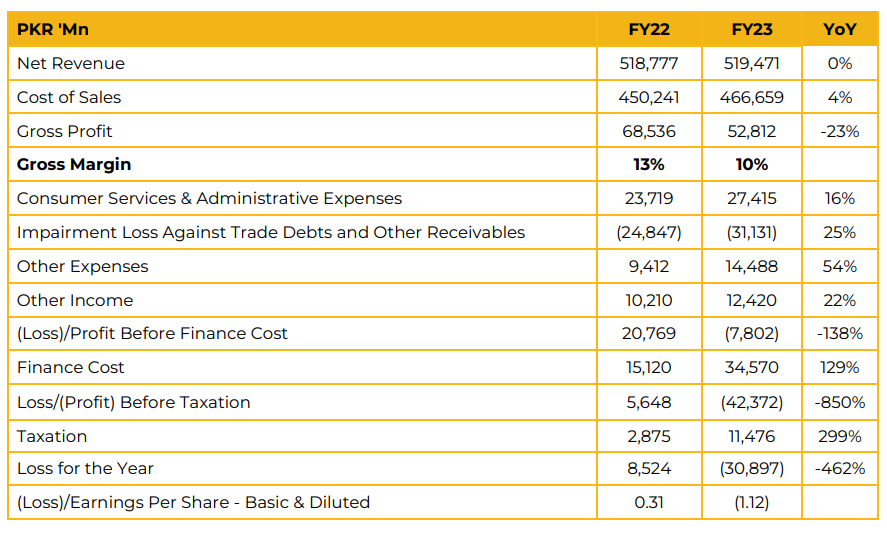

KEL reported a net loss of PKR 30.90 billion (LPS: PKR 1.12) in CY23, compared to net profit of PKR 8.52 billion (EPS: PKR 0.31) in CY22. Following the recent issuance of K-Electric’s Multi-Year Tariff (MYT) determination by NEPRA, the company conducted a corporate briefing session to provide detailed clarifications, address prevailing misconceptions, and engage directly with analysts and shareholders

Uniform Tariff Policy:

The Consumer Tariff is uniform across all of Pakistan and is set by the Ministry of Energy based on the Government of Pakistan’s Uniform Tariff Policy. This means the tariff charged to a customer in Karachi is the same as in Lahore, Peshawar, or Multan.

Determined Tariff vs. Consumer Tariff:

NEPRA determines the total tariff based on the cost of service (Generation, Transmission, Distribution, Supply costs and returns). The Government then sets the Consumer Tariff, which is uniform nationwide

Tariff Differential Claim (TDC):

The difference between the NEPRAdetermined tariff and the government-set uniform Consumer Tariff is the TDC. This claim is provided to KE to compensate for the subsidized tariff charged to consumers. Management clarifies that this is a subsidy for consumers, not for KE. A major component of the TDC is attributed to the non-fulfilment of local gas commitments, forcing KE to use more expensive RLNG. Management argues that if KE were supplied local gas as per original commitments, the energy purchase price would decrease significantly, potentially reducing the total determined tariff close to the uniform consumer tariff, thereby reducing or eliminating the TDC.

Control Period:

Generally, 7 years for Generation (except BQPS-III which is 11 years), Transmission, Distribution, and Supply.

Return on Equity (RoE):

NEPRA determined a USD-based RoE of 14% for Generation (vs. KE’s ask of 15%), 12% for Transmission (vs. KE’s ask of 15%), and 14% for Distribution (vs. KE’s ask of 16.67%). Management noted that the previous MYT allowed higher dollarized returns (15% for Transmission, 16.67% for Distribution) and that KE’s allowed returns are lower than some other power sector entities.

Cost of Debt (CoD):

Allowed local loans at KIBOR + actual spread (capped at 2%) and foreign loans at SOFR + actual spread (capped at 4.5%), lower than KE’s ask. Exchange gain/loss on actual repayment of unhedged foreign loans is pass-through.

Capital Structure (D:E Ratio):

NEPRA allowed 70:30 Debt:Equity ratio, aligning with KE’s request and the standard in the power sector. However, management noted that NEPRA applied this notional ratio to KE’s actual equity base, treating KE’s equity investment as notional debt in some cases, reducing the allowed return compared to what would be received on actual equity

Depreciation: Allowed based on straight-line over plant life for most plants, with debt repayment period (11 years) for BQPS-III.

Insurance: Allowed based on actual with a capping of 0.7% of EPC Cost for Generation, lower than KE’s ask of 1.0% and lower than some other IPPs

Fuel (Take or Pay): NEPRA allowed Take or Pay (ToP) for BQPS III RLNG post increase in supply from the National Grid or implementation of Central Despatch, linking capacity payments to fuel availability and outage allowance. KE filed a review motion arguing its signed contract with PLTL has a 75% ToP commitment which should be allowed. Responsibility for fuel arrangement lies with KE.

Working Capital: Allowed as per standard methodology, but NEPRA disallowed working capital on opening receivables and systematic lag on fuel & quarterly adjustments.

Heat Rates: Approved with adjustments for part load and degradation curves to be approved based on independent engineer reports. A claw-back mechanism for efficiency gains is included.

T&D Loss Targets: Transmission loss for FY24 allowed at actual (0.75%). Distribution Loss for FY24 allowed at 13.90%, lower than KE’s actual in FY23. Targets for FY25-FY30 will be decided in the investment plan review. NEPRA disallowed adjustment of distribution loss targets due to changes in sales mix, despite management arguing this is beyond KE’s control.

Recovery Loss: An improvement curve from 6.75% in FY24 down to 3.5% by FY2030 was allowed. Annual adjustment is based on the lower of allowed percentage, actual percentage, or provision for impairment. This means if actual recovery is better than the target, the lower actual loss percentage is allowed as cost. NEPRA disallowed the Cap & Floor mechanism and adjustment for sales mix change in recovery loss. Management noted their actual recovery loss is significantly higher than the allowed allowance, creating an incentive to improve.

Determined Tariff FY 2024: The total determined tariff for FY 2024 is 39.98 PKR/KWh, which is about PKR 4 lower than KE’s requested tariff of PKR 44. The components are:

• Energy Purchase Price (EPP): 19.20 PKR/KWh.

• Capacity Purchase Price (CPP): 12.76 PKR/KWh. This includes KE’s capacity cost and capacity cost from external sources including NTDC.

• Transmission Charges: 2.86 PKR/KWh.

• Distribution Charges: 3.31 PKR/KWh.

• Supply Charges: 2.29 PKR/KWh.

• Prior Year Adjustment (PYA): (0.44) PKR/KWh.

Circular Debt & Recovery Loss: Recovery loss is a major issue in the Pakistan power sector, contributing to circular debt. Other DISCOs (XWDISCOs) generally have higher recovery losses and AT&C losses than KE. Management stated that KE’s performance improvements have resulted in PKR 900 billion savings for the government and consumers, which otherwise would have been part of circular debt.

They claim that KE’s costs do not contribute to the current 2.7 trillion circular debt. Impact of Local Gas Non-provision: Management strongly argues that the higher KE tariff compared to XWDISCOs is solely due to the non-provision of local gas, forcing reliance on more expensive RLNG. If local gas were provided, the base tariff EPP would reduce from 19.20 PKR/KWh to PKR 11.92/KWh, a reduction of over PKR 7/KWh.

Furthermore, unlike CPPA-G (representing XWDISCOs), KE’s generation fleet does not include Nuclear or Hydro power plants, which typically have lower energy costs. Management presented a comparison showing that if the Nuclear and Hydel components are removed from the National Grid’s pool price, KE’s generation cost (34.5 PKR/unit) is cheaper than the National Grid’s comparable cost (38.7 PKR/unit). T&D Investment Plan: NEPRA issued a decision approving PKR 392,290 million for the investment plan in April 2024.

KE filed a Motion for Leave for Review on May 13, 2024. Write-off Claims & End of Term Adjustments: Public hearings were held on KE’s write-off claims (PKR 67B recorded, plus an additional 8B claimed recently), but NEPRA’s determination is still awaited. Management noted that the previous MYT allowed for write-offs based on a specific process, while the new MYT allows for recovery allowance annually.

Settlement of Historic Receivables/Payables: A Mediation Agreement was signed between KE, GoP, CPPA, NTDC, SSGC, and KWSB. KE is engaged with stakeholders for a settlement regarding historic disputes, including mark-up claims. Sent-Out Electricity: Declined in FY24 vs. FY23 due to economic contraction and reduced industrial demand. 9MFY25 showed

improvement driven by economic stabilization and increase in residential consumption.

T&D Loss: Increased from 15.3% (FY23) to 16.0% (FY24) and 14.4% (9M FY25). Increase in FY24/9MFY25 attributed to sent-out mix deterioration (lower industrial consumption) and increased theft due to tariff increases.

Generation Efficiency: Improved from 42.2% (FY23) to 45.9% (FY24), reaching 46.6% in 9MFY25 due to generation mix shift.

Recovery Ratio: Declined from 93.3% (FY23) to 90.6% (9MFY25). Management attributed this to steep tariff hikes (42.7% in FY24, 9.2% in 9MFY25) impacting affordability in low-income areas.

Renewable Initiatives: KE is committed to increasing the share of cheaper and greener energy, aiming for 30% renewables in generation capacity by 2030.

• Planned Addition: Target to add 1,282 MW of renewables (868 MW Wind, 332 MW Solar, 82 MW Hydel).

• Competitive Bidding: KE is stated to be the first to successfully complete competitive bidding for 640 MW of renewable projects.

• Successful Bids & Low Tariffs: Competitive bidding resulted in very low tariffs, described as breaking records and among the lowest in history. Examples include:

o 220 MW Solar-Wind Hybrid at Dhabeji: PKR 8.92/kWh.

o 150 MW Solar at Deh Metha Ghar & 120 MW Solar at Deh Halkani (Sindh): PKR 9.83/kWh.

o 100 MW Solar at Bela: PKR 11.21/kWh.

o 50 MW Solar at Winder: PKR 11.65/kWh.

• These projects are expected to significantly reduce generation costs and add clean energy to KE’s system. KE will purchase power from these competitively bid projects, which are being developed by Independent Power Producers (IPPs), with KE not necessarily investing equity in them, except for an 18 MW solar project under a KE subsidiary.

Going forward, KE is discussing with the GoP the conversion of the Jamshoro imported coal project to local coal and potentially becoming the direct power off-taker via a Power Purchase Agreement (PPA) directly with KE, not the National Grid. KE currently purchases 1600 MW from the National Grid under an agreement. Discussions have progressed to potentially increase this to 2000 MW on a firm basis, with an initial revised amendment agreed upon. Further increases would require GoP commitment and interconnections. Power is purchased at the National Grid’s basket price, not the specific source price (e.g., Nuclear)

Responding to some questions the management:

• reiterated that the benefit of KESC privatization resulted in PKR 900 billion savings to the government.

• clarified that AT&C loss includes T&D loss plus recovery loss.

• noted regarding write-off claims/recovery allowance that PKR 67 billion has been recorded as receivable. An additional PKR 8 billion claim was submitted. The total claim is being reviewed by NEPRA. Explained that the recovery allowance sets a target, and actual performance below the target requires KE to absorb the cost.

• mentioned regarding exchange losses that past losses are incurred, but the determination allows indexation for future foreign loans, making exchange losses on actual repayment pass-through.

• highlighted regarding T&D Investment Plan Financing that the PKR 392 billion plan will be financed through a mix of debt and equity, requiring significant foreign debt due to local banking limits and State Bank regulations.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.