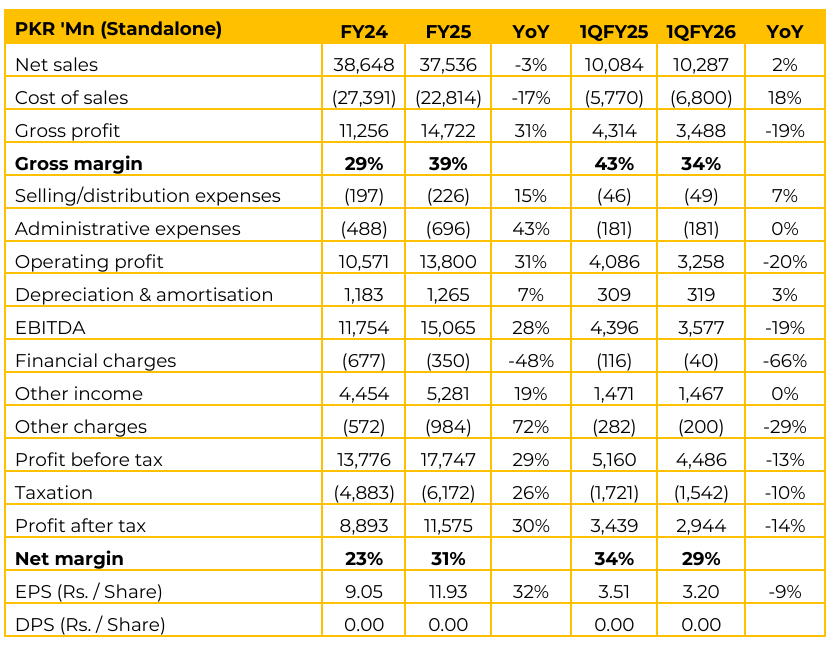

KOHC has reported standalone earnings per share of PKR 11.93 in FY25 (FY24: PKR 9.05). Furthermore, in 1QFY26 the company reported EPS of PKR 3.20 (1QFY25: PKR 3.51).

Total Capacity Utilization of KOHC in FY25 remained 46.4% (FY24: 52.2%). 1QFY26 saw an 18% increase in cement dispatches, but this was offset by price pressures resulting in revenue loss.

Cost of Sales per ton in FY25 decreased to PKR 9,798 (FY24: PKR 10,593/ton). Retention increased to PKR 16,121/ton in FY25 (FY24: PKR 14,946/ton). This combination drove the strong FY25 margins. However, retention decreased in 1QFY26 due to competitive nature of the market.

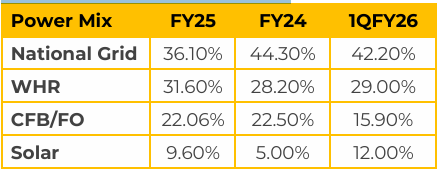

Power mix remained as follows:

The company is no more using Furnace Oil for power generation

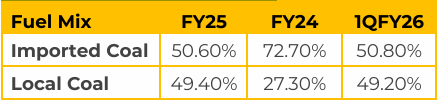

Fuel mix remained as follows:

KOHC has significantly shifted away from imported coal towards local coal. The company is aiming to utilize 60% local coal.

KOHC is setting up a 28.5 MW Coal Power Plant at the plant site. Installation and commissioning are in the process. Expected to be concluded by the end of FY26 (maximum 1QFY27).

The company has also set up a 15.34 MW solar power plant. This will increase total solar capacity to 20 MW.

Going forward, the company is planning a new green field cement production line in Khushab. Import of plant and machinery shall be finalized when sustained improvement in domestic cement demand is achieved.

Management is confident that the market will gradually stabilize and reach equilibrium. Despite continued high cost of construction since 2021, local cement industry dispatches are expected to see double-digit growth given the lower-base in the preceding years.

KOHC is part of the consortium led by Lucky Cement for the acquisition of PIA.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.