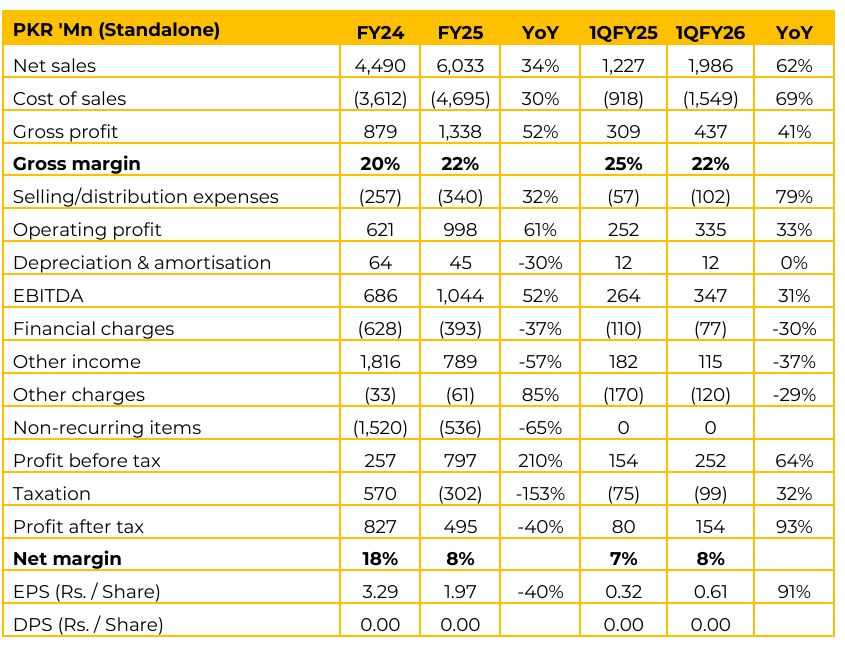

LOADS has reported standalone earnings per share of PKR 1.97 in FY25 (FY24: PKR 3.29). Furthermore, in 1QFY26 the company reported EPS of PKR 0.61 (1QFY25: PKR 0.32).

Management noted that the auto sector generally faced recession in FY23 and FY24 due to economic/political instability, forex crises, and import restrictions from the SBP. FY25 marked the start of recovery. Major car assemblers saw significant growth in 2025, resulting in an overall increase of approximately 41% in terms of car units assembled.

Loads Limited is mainly dependent on OEM sales, accounting for around 90% of revenue. Key customers include Toyota, Honda, and Pak Suzuki. Yamaha was also a major customer in FY25 but has since decided to cease operations in Pakistan.

Product-wise sales contribution in FY25 remained as follows:

• Muffler/Exhaust system: 61%

• Sheet metal: 35%

• Radiators: 4%

Radiator sales were very low because major OEMs have converted their technology from copper/brass radiators (which Loads manufactures) to aluminum radiators.

Management predicted a very good sale in FY26, targeting a growth somehow 30% ahead of 2025. Separately, overall auto industry growth is expected to be between 25% to 30% YoY.

The company is aggressively approaching the aftermarket segment (local and export) for copper/brass radiator cores and exhaust systems.

The company is exploring UAE and African markets for exporting copper/brass radiator cores and exhaust systems. Management highlighted that the export potential is significant (under USD 100 million), but the approvals process is time-consuming. Loads expects to fetch revenue equivalent to 10% to 15% of OEM revenue from the aftermarket during FY26, with contributions moving up in subsequent years.

The aftermarket business is generally cash-driven (often receiving advance payment), which is expected to have a significant positive impact on the company’s working capital position.

In the next three years, the company expects copper/brass radiator sales contribution to grow significantly, reaching 35% to 40% of the OEM revenue. Loads is engaged in discussions with new OEMs for localizing sheet metal and exhaust system parts.

These OEMs will need to localize their major components to avoid extra duties when their initial tax exemptions end in FY26. The company is exploring the viability of manufacturing aluminum radiators for both aftermarket and OEMs. An aluminum radiator plant will be installed soon. The strategy is to test the market depth and product quality in the aftermarket first before approaching OEMs for aluminum radiator demand.

Recently, Loads decided to carry out a right issue of around 120 million shares to raise approximately PKR 1.5 billion. The plan is to meet working capital requirements, fund growth capital needs, and capture the increased demand from OEMs. Tentative subscription is expected around mid-January onward, with the right issue expected to be completed by the end of February. A director loan of approximately PKR 700 million is planned for repayment.

Management expects to repay this partially or fully on an installment basis during FY26, contingent upon quick cash generation from the aftermarket segment. Regarding alloy-wheel plant, management noted that since the auto-sector has recovered very recently, there’s a very limited interest in plant. However, the management is in talks with a local entity along with some Chinese entities for Joint Venture.

It would require another PKR 2-3 billion to make this plant operational and thus it is currently not viable for Loads to do so. Going forward, management will strive for better gross margins or at least maintain similar levels. The ultimate goal of high-tech alloy wheel plant is to make it operational either through outright sale or joint venture.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.