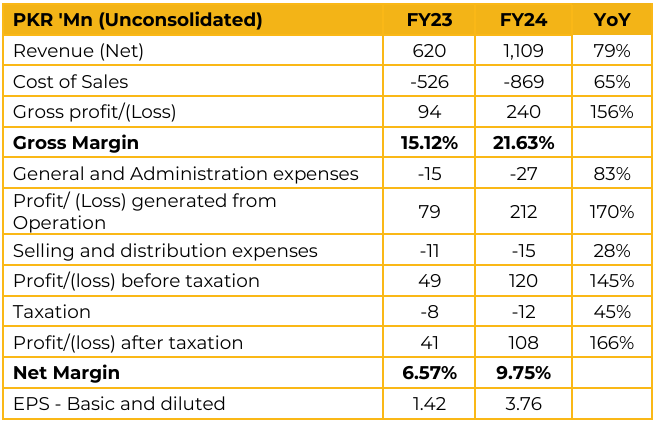

Mandviwala Mauser Plastic Industries Limited recorded earnings per share of PKR 3.76 in FY24, as compared to earning per share of PKR 1.42 in FY23. Production began in July 2020 with 210-liter plastic drums as the main product. In 2023, the company added a 260-liter product and has since introduced more.

The company focuses on large blow-molded containers. It initially entered the chemical sector, then expanded into the food sector, and is now looking to enter the lube oil sector. The company started as the eighth or ninth producer in the 210 liter market. By introducing lighter-weight drums produced with their German plant, they have become the second-largest market shareholder in the chemical and food sectors within three to four years.

Their current market share in the 210-liter sector is approximately 25-30%, with the potential to reach 50% in the future. The company found that its competitors struggle to produce similar lightweight drums due to limitations in their machinery, which is often sourced from China and compromises quality for price. It currently manufactures 160-liter and 120-liter open-top drums, which are primarily used in the chemical, textile, and food industries. The company also plans to diversify into industrial crates, made from injection molding, for the food, automotive, and textile industries.

The company commands a price premium and high margins due to the strategic sourcing of polyethylene through larger contracts and volumes, which secures better pricing. Competitors often rely on local traders for their supply, losing these price benefits.

Going Forward, The company is looking at decent growth in the lubricant and ethanol sectors, as well as continued growth in the chemical business with new companies emerging. Despite recent regional conflicts that affected businesses, things have picked up since July.

The company is considering further capital expenditure (CAPEX) investments to increase capacity. They anticipate reaching 70-80% capacity utilization within two years due to expected market growth.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.